How was my day?

Well, I didn't get much research done, and I didn't get too much done on my classes either. I did meet with a student for about an hour while on a presentation that my class has to give to our outside advisory board.

But other than that, I didn't get much done. But I'm happy anyway.

Why? Because I just saved a bunch of money on my mortgage. I refinanced it from its initial 6.25% rate to a new rate of 5.75%. Total costs (once the escrow gets paid back in about a month) were about $1500. So, the decrease in the mortgage payment means I pay back costs in about a year, and after that I'm $1,500 to the good each year.

Not bad. The Unknown Wife and I are trying to save some money, but we celebrated by going out to the loval Java shop for a couple of good cups (Kona for her, a Latte for me) and an extremely rich pastry.

Yeah-- with two kids (and a still hefty, but less so after today mortgage), this is about as much as we end up splurging.

30 Kasım 2006 Perşembe

29 Kasım 2006 Çarşamba

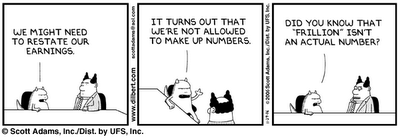

Earnings Restatements, Dilbert Style

Here's one for the "to use in class" file (from Dilbert.com website.)

And a tip-o-the-hat to The Big Picture for the link

And a tip-o-the-hat to The Big Picture for the link

The Unknown Son and Late-Stage Effects of Chemo (and a Link Dump, of course)

Today's a bit busy - I teach in the morning, and meet Unknown Wife immediately after so we can go to meet Unknown Son's new oncologist. He's in remission from his Neuroblastoma, so it's not a "serious" meeting. But he does have to issues to deal with.

Most chemotherapy works primarily by attacking ALL fast-growing cells, and he's had a lot of it. So, it often has implications for childhood growth. Unknown Wife and I are both on the smallish side, so we didn't expect U.S. to be a giant in any case. But he's by far the smallest in his class (most people guess him to be about 6 instead of 8, at least until he open his mouth). In addition, he probably has some slight neuropathy (nerve damage), which is a common side effect of pediatric chemo. Both U.W. and I have the reflexes of tree sloths, but U.S. is even more uncoordinated.

In any event, the new oncologist has specialized in late-stage effects of chemo. She actually did "write the book". So, we'll be consulting with her today to determine what options we have, or even if we need to be concerned.

Meanwhile, here's some stuff to keep you busy:

Most chemotherapy works primarily by attacking ALL fast-growing cells, and he's had a lot of it. So, it often has implications for childhood growth. Unknown Wife and I are both on the smallish side, so we didn't expect U.S. to be a giant in any case. But he's by far the smallest in his class (most people guess him to be about 6 instead of 8, at least until he open his mouth). In addition, he probably has some slight neuropathy (nerve damage), which is a common side effect of pediatric chemo. Both U.W. and I have the reflexes of tree sloths, but U.S. is even more uncoordinated.

In any event, the new oncologist has specialized in late-stage effects of chemo. She actually did "write the book". So, we'll be consulting with her today to determine what options we have, or even if we need to be concerned.

Meanwhile, here's some stuff to keep you busy:

CXO Advisory group has been going back and forth with Jim Cramer on his investment performance. I think they've gotten under his skin.Enough bloggery - back to work.

Theresa Lo is guest blogging at Alpha and Omega about "computer-replicated hedge funds". It seems that there are a couple of groups that are trying to do it on an automated basis that claim they can do it better than a flesh-and-blood manager.

Worthwhile Canadian Initiative has some good advice on how to present (or discuss) an academic paper.

John Prestbo at Marketwatch.com goes over the ins, outs, ups, and downs of hedge fund indexes. To quote Inigo Montoya, "I don't think that means what you think it means".

28 Kasım 2006 Salı

Slouching Toward The End Of The Semester

There's exactly two weeks (6 classes) left to the semester, and I have a little more than two chapters of material to cover. I actually have three chapters to cover, but since we're only taking parts of them, it works out to about 2 1/2 chapters. So, there's a bit of a time crunch. But there always seems to be at the end, so nothing new here.

I still have hopes of getting a paper out to a journal by the end of the semester. Stuff submitted just before the break always seems to take longer to get a referee report back on, but if I wait until we get back for the spring semester it'll be even longer. So I might as well punch it out and get it situated on some editor's desk (so he can get it on a reviewer's desk).

While I'm finishing up the edits, here are some links to keep y'all busy:

I still have hopes of getting a paper out to a journal by the end of the semester. Stuff submitted just before the break always seems to take longer to get a referee report back on, but if I wait until we get back for the spring semester it'll be even longer. So I might as well punch it out and get it situated on some editor's desk (so he can get it on a reviewer's desk).

While I'm finishing up the edits, here are some links to keep y'all busy:

The Wall Street Journal has a piece titled "The November Effect"that says that the stock prices of big winners (and losers) reverse course in November. I'm not aware of any academic research that shows this, but I'm more of a corporate guy. Still, it's interesting.Enough bloggery - back to work.

Matthew Goldstein of Thestreet.com is reporting on leveraged private-equity backed IPOs (or LIPOs, as they're commonly known). PE-backed IPOs accounted for 42% of all offereings this year, so they've become a significant part of the IPO market.

This week's Carnival of the Capitalists is up at Blueprint For Financial Prosperity. My pick of the week is the post by gongol.com that claims that responding to penny-stock internet spam may be unwittingly funding terrorism.

The Wall Street Journal online has a piece on Information networks.

It seems that there are now companies that pay industry "consultants" to gain superior information about the firms (or industries). Larry Ribstein says it's the inevitable consequence of Reg FD.

Eszter Hargittai gives a primer on how to send emails to academics correctly. If you're a reporter or someone trying to get help from one of my tribe read it - it's got some very good info.

Marketwatch.com reports on "Fundamental etf's" - ETFs that base portfolio wieghts not on market cap, but on factors like sales, market-book, market share, and so on.

26 Kasım 2006 Pazar

The Seven-Headed Dragon

[I put a revised edition of this blog entry into my website "Living Without Money"]

Wail, you inhabitants of the market district!

Wail, you inhabitants of the market district!For all the merchant people are cut down;

All those who handle money are cut off.

(Zepheniah 1:11)

And there is no merchant any more

in the Temple of Yahweh of Hosts in that Day!

(Zechariah 14:21)

in the Temple of Yahweh of Hosts in that Day!

(Zechariah 14:21)

Today is probably my last day house-sitting, so I'll use the time to write here.

I had a nice thanksgiving dinner at my friends', Damian & Dorina. She made an incredibly delicious vegetarian nut loaf.

After dinner, we discussed different philosophies and such. Then a friend brought to my attention, and not at all in a nice way, that I tend to interrupt and dominate the conversation. I have always thought of myself as a listener who doesn't talk much. And I like to think of myself as "aware." But I had to concede that he was right, though. Sometimes I get excited about stuff I'm learning and tend to forget about others. Just when I think I'm getting it together, I find I'm not. Knowledge isn't enlightenment. In fact, as I keep saying, it veils us from enlightenment. Anyway, I've been licking my ego wounds a lot since. And just that fact of still feeling wounded shows a great attachment to this ego that I thought I had pretty much overcome.

That's also a problem with blogging like this. You can only see words, not my person. And it's easy to present ourselves as flawless to the world when we write.

Comment Reply Becomes Blog Entry

I started writing a reply to a comment by "Angeldust" after "My Summary of Why I Live Moneyless". Then I decided to just go ahead and make it a blog entry.

It's time to see the Bible in a whole new light. It's time to shake up tired, sleeping JudeoChristian religion out of its materialistic stupor. This might just blow you away.

Angeldust brought up the Beast in the book of Revelation, the Beast who has 7-heads, the AntiChrist that end-of-timers like to talk about. So I started tracing this 7-headed dragon back to the very serpent in the Garden of Eden. Here's a taste of the mysteries:

Serpent Coiled Around the Tree, Serpent Coiled Around Pole

In Genesis 3:13 Eve says, "The serpent [nahash*] deceived [nasha*] me." The Hebrew Bible is filled with plays on words totally missed in translation. The word nasha* means both 'deceive' and 'lend on interest,' or 'be creditor'. (In Strong's Lexicon, 'deceive' is Srong's # 5377 & 'lend on interest' is 5378, which are identical)*. This nasha is found in 1Sam 22:2, Neh 5:7, Psa 89:22, Isa 24:2, all of which, like the Koran, strongly denounce lending at interest).

In Genesis 3:13 Eve says, "The serpent [nahash*] deceived [nasha*] me." The Hebrew Bible is filled with plays on words totally missed in translation. The word nasha* means both 'deceive' and 'lend on interest,' or 'be creditor'. (In Strong's Lexicon, 'deceive' is Srong's # 5377 & 'lend on interest' is 5378, which are identical)*. This nasha is found in 1Sam 22:2, Neh 5:7, Psa 89:22, Isa 24:2, all of which, like the Koran, strongly denounce lending at interest).Now look at the Hebrew word for snakebite, nashak [Strong's

5391]* , which also happens to mean both 'lend' and 'receive on interest' (Num 21:6-9, Deut. 23:19, Prov. 23:32, Jer. 8:17, Amos 5:19, etc). 'The serpent bit me,' Eve says. 'The serpent charged me interest,' Eve says.

5391]* , which also happens to mean both 'lend' and 'receive on interest' (Num 21:6-9, Deut. 23:19, Prov. 23:32, Jer. 8:17, Amos 5:19, etc). 'The serpent bit me,' Eve says. 'The serpent charged me interest,' Eve says.Now the word for serpent, nahash is also a wordplay with nasha. Nahash also means 'divination,' and also 'copper' or 'bronze,' the basic currency [Strong's 5174 & 5], just like our English word 'cobra' is related to 'copper'. You can see this play on words taken into the story of Moses lifting up the Bronze Serpent in the wilderness.

_____________________________________

So Moses made a bronze [nahashet] serpent [nahash], and put it on a pole; and so it was, if a serpent [nahash] had bitten [nashak] anyone, when he looked at the bronze [nahashet] serpent [nahash], he lived. (Numbers 21:9)

If a serpent had bitten anyone can literally be translated, if a serpent had become creditor to anyone...!

Now it gets even more intriguing. a varient spelling of nasha [# 5375], pronounced the same, means 'to lift up, bear up, carry, be exalted, bear sins, atone for sins.' And the related word for 'debt' is nashi [5386]. Now you can see clearly what Jesus is referring to when he says, As Moses lifted up the serpent in the wilderness, so must the Son of Man be lifted up. (John 3:14)

This word nasha is used first by Cain in Genesis 4:13, "This punishment is more than I can bear [nasha].' And the word 'Cain' itself is a pun on the word canah, which means 'purchase'! Again, the play on words:

If a serpent had bitten anyone can literally be translated, if a serpent had become creditor to anyone...!

Now it gets even more intriguing. a varient spelling of nasha [# 5375], pronounced the same, means 'to lift up, bear up, carry, be exalted, bear sins, atone for sins.' And the related word for 'debt' is nashi [5386]. Now you can see clearly what Jesus is referring to when he says, As Moses lifted up the serpent in the wilderness, so must the Son of Man be lifted up. (John 3:14)

This word nasha is used first by Cain in Genesis 4:13, "This punishment is more than I can bear [nasha].' And the word 'Cain' itself is a pun on the word canah, which means 'purchase'! Again, the play on words:

Now we can see why there is a Jewish interpretation that Cain is actually the son of the Serpent! He is the son of purchase, of credit & debt, while Abel is the son of Grace.

Mayan Ouroboros

The Seven-Headed Dragon Next, in the story of Cain, you see allusion to the 7-headed

Next, in the story of Cain, you see allusion to the 7-headed  Leviathan (Hydra, Beast) with the 7-fold vengeance of Cain in Genesis 4:15 & 24. Now it is clear that this credit-and-debt 7-head Serpent is poking his heads up in Deuteronomy 28! He is Leviathan.

Leviathan (Hydra, Beast) with the 7-fold vengeance of Cain in Genesis 4:15 & 24. Now it is clear that this credit-and-debt 7-head Serpent is poking his heads up in Deuteronomy 28! He is Leviathan.'Leviathan' shares the same root as 'Levi,' meaning "to twist, bind, join [3878 &3867]. Again, notice the word-play in the passage that speaks of the birth of Levi, the father of law:

"'Now this time my husband will be bound [lavah] to me,...' therefore he was named Levi." (Gen. 29:34).

Levi was the father of the tribe of Levi, the Priestly Clan, the establishers of Levitical Law, starting with the Levites called Moses, Aaron, and Miriam. Law is consciousness of Credit and Debt. Law is control of Credit and Debt. The Levitical Law, as all law, was given to manage people under Consciousness of Credit and Debt, a way of keeping disease in check until the cure comes - the cure of Grace. Just as Krishna speaks of transcending the cycles of Credit and Debt, transcending the perpetual reincarnation of Karma, the old Hindu Law, through crucifixion of the ego, so speaks the Buddha, so speaks the Christ.

Leviathan is the Hebrew word for the Canaanite Lotan, found in Ugaritic texts, where he is slain by Baal:

“When you smite Lotan, the fleeing serpent,

“When you smite Lotan, the fleeing serpent, finish off the twisting serpent,

the close-coiling one with seven heads."

( KTU 1.5:I:1-3, D. Pardee in CS, 1.265)

Then the Bible quotes this Canaanite text, saying Yahweh slays Lotan/Leviathan:

IN that day Yahweh with His severe sword, great and strong,

Will punish Leviathan the fleeing serpent,

Leviathan that twisted serpent;

And He will slay the dragon that is in the sea. (Isaiah 27:1)

You broke the heads of Leviathan in pieces,

And gave him as food to the people inhabiting the wilderness. (Ps 74:14)

Land of Canaan, Land of Commerce

Leviathan is the Serpent of Canaan. Canaan means trade, or commerce in Hebrew. Here again we see the play on the words for 'Cain' & 'purchase'. The land of Canaan, called Palestine and Israel today, was wedged between two great superpowers, Babylon and Egypt, and two great continents. This made it the land of Trade - the land of war, oppression, and deceit - the products of Trade. And it was out of this that the rage of the Bible is born.

Now you can see, more and more, studying both the Bible and history, that the Canaanites were not a literal race of people, but were the Spirit of Merchandise that possessed the people. And the very theme of the Torah is to wipe out every vestige of Canaanite from the land. The later Jewish prophets confirm that this is so:

Wail, you inhabitants of the market district!

For all the merchant people [canaanites] are cut down;

All those who handle money are cut off. (Zeph 1:11)

And there is no merchant [canaanite] any more in the temple of Yahweh of Hosts in that day! (Zechariah 14:21)

And Jesus' clearing the merchants from the temple is a direct act-out of this Zechariah scripture. Wiping out the Canaanites.

Yes, the mystery is that the Levitical law is to become fulfilled, to become obsolete at the End of Time, which is the Eternal Now, the Day of Yahweh. Money/trade serves its purpose and becomes obsolete. All written law becomes fulfilled, obsolete.

Money and law simply cannot exist in the Present, in Reality! This is not opinion. This is simple observation, if we but look inside.

It's interesting that, in the Christian Bible, the Greek word for money is nomisma and the word for law is nomos, sharing the same root meaning "to parcel out." There is no need for law when there is no money or barter, and there is no need for money when there is no law - for both are one and the same - control of credit and debt. When you start trusting Nature again "to parcel out", that vengeance, repayment, belongs to God, not human ego-mind, then Balance comes, as it already exists in the infinite Universe surrounding our little bubble of "civilization". And this is the very theme of Christian theology: freedom from written law and taking on the law of the heart, which is love. Crucifying the Ego, which is Consciousness of Credit and Debt.

again "to parcel out", that vengeance, repayment, belongs to God, not human ego-mind, then Balance comes, as it already exists in the infinite Universe surrounding our little bubble of "civilization". And this is the very theme of Christian theology: freedom from written law and taking on the law of the heart, which is love. Crucifying the Ego, which is Consciousness of Credit and Debt.

Will punish Leviathan the fleeing serpent,

Leviathan that twisted serpent;

And He will slay the dragon that is in the sea. (Isaiah 27:1)

You broke the heads of Leviathan in pieces,

And gave him as food to the people inhabiting the wilderness. (Ps 74:14)

Land of Canaan, Land of Commerce

Leviathan is the Serpent of Canaan. Canaan means trade, or commerce in Hebrew. Here again we see the play on the words for 'Cain' & 'purchase'. The land of Canaan, called Palestine and Israel today, was wedged between two great superpowers, Babylon and Egypt, and two great continents. This made it the land of Trade - the land of war, oppression, and deceit - the products of Trade. And it was out of this that the rage of the Bible is born.

Now you can see, more and more, studying both the Bible and history, that the Canaanites were not a literal race of people, but were the Spirit of Merchandise that possessed the people. And the very theme of the Torah is to wipe out every vestige of Canaanite from the land. The later Jewish prophets confirm that this is so:

Wail, you inhabitants of the market district!

For all the merchant people [canaanites] are cut down;

All those who handle money are cut off. (Zeph 1:11)

And there is no merchant [canaanite] any more in the temple of Yahweh of Hosts in that day! (Zechariah 14:21)

And Jesus' clearing the merchants from the temple is a direct act-out of this Zechariah scripture. Wiping out the Canaanites.

Yes, the mystery is that the Levitical law is to become fulfilled, to become obsolete at the End of Time, which is the Eternal Now, the Day of Yahweh. Money/trade serves its purpose and becomes obsolete. All written law becomes fulfilled, obsolete.

Money and law simply cannot exist in the Present, in Reality! This is not opinion. This is simple observation, if we but look inside.

It's interesting that, in the Christian Bible, the Greek word for money is nomisma and the word for law is nomos, sharing the same root meaning "to parcel out." There is no need for law when there is no money or barter, and there is no need for money when there is no law - for both are one and the same - control of credit and debt. When you start trusting Nature

again "to parcel out", that vengeance, repayment, belongs to God, not human ego-mind, then Balance comes, as it already exists in the infinite Universe surrounding our little bubble of "civilization". And this is the very theme of Christian theology: freedom from written law and taking on the law of the heart, which is love. Crucifying the Ego, which is Consciousness of Credit and Debt.

again "to parcel out", that vengeance, repayment, belongs to God, not human ego-mind, then Balance comes, as it already exists in the infinite Universe surrounding our little bubble of "civilization". And this is the very theme of Christian theology: freedom from written law and taking on the law of the heart, which is love. Crucifying the Ego, which is Consciousness of Credit and Debt.

It is about giving up the ego to the cross, lifting up Moses' serpent on a pole in the wilderness, the Lamb breaking through the Seven Seals.

It is about giving up the ego to the cross, lifting up Moses' serpent on a pole in the wilderness, the Lamb breaking through the Seven Seals.  *If you want to confirm these word studies, you can go to www.blueletterbible.org to look up the Hebrew, Greek, and Aramaic words of scripture passages, or www.scripture4all.org/OnlineInterlinear/Hebrew_Index.htm for Hebrew-English interlinear Tanach (Old Testament), and www.scripture4all.org/OnlineInterlinear/Greek_Index.htm for Greek-English interlinear New Testament. The Blue Letter Bible uses Strong's Lexicon, so I've put in Strong's numbers to make it easier for you to look up.

*If you want to confirm these word studies, you can go to www.blueletterbible.org to look up the Hebrew, Greek, and Aramaic words of scripture passages, or www.scripture4all.org/OnlineInterlinear/Hebrew_Index.htm for Hebrew-English interlinear Tanach (Old Testament), and www.scripture4all.org/OnlineInterlinear/Greek_Index.htm for Greek-English interlinear New Testament. The Blue Letter Bible uses Strong's Lexicon, so I've put in Strong's numbers to make it easier for you to look up.24 Kasım 2006 Cuma

A Good Thanksgiving For The Unknown Family- Now Back To Work

After a short (about 90 minute) drive, we had a great Thanksgiving at the house of the Unknown Sister-in-law. In addition to us, there were Unknown Wife's two sisters (both with spouses and two children), Unknown Grandparents, and our neighbor from when we lived in the MidWest who now lives about an hour away (we moved halfway across the country, and so did she). Good food, conversation, and fun was had by all. Here's hoping your Thanksgiving went as well. One of the more touching moments was when Unknown Son gave the blessing for the food and prayed for his cousin, who also has Neuroblastoma (he actually had it before Unknown Son and went into remission before U.S. was diagnosed, Then last year, the canvcer came back for his cousin).

Then last night, Unknown Wife and Kids took advantage of the opportunity to stay with Unknown Sister-In-Law and her family (we'd planned it earlier this week). So, I drove back, got an early night's sleep, and will work on research and classes until Saturday and their return (it's the end of the semester, so everything gets backed up).

In the meanwhile, here are a few links for your reading pleasure:

Then last night, Unknown Wife and Kids took advantage of the opportunity to stay with Unknown Sister-In-Law and her family (we'd planned it earlier this week). So, I drove back, got an early night's sleep, and will work on research and classes until Saturday and their return (it's the end of the semester, so everything gets backed up).

In the meanwhile, here are a few links for your reading pleasure:

Abnormal Returns has done a very nice piece on the Five C's of Private Equity Buyouts. It discusses some of the factors that have led to the growth of PE as a major force in the market. They areFinally, here's a quote by J.R.R. Tolkien to think about for the remainder of the day: "I don't know half of you half as well as I should like; and I like less than half of you half as well as you deserve."Now back to work!Read the whole thing here, and a follow up piece here.

- Capital

- Credit

- Complexity

- Control

- Congress

Jim Mahar at FinanceProfessor.com links to a piece by Brav, Graham, Harvey, and Michaely on payout (i.e. dividned and repurchase) policy. Anyone teaching advanced corporate finance should read it and give it to their class. It's another of Graham's great survey pieces, and shows what managers actually do (and what a surprise: sometimes it's different from what finance textbooks say they should do). And if you want to read more of Graham's research, click here. He also has a good survey piece that covers a broader range of topics in general corporate finance,

In addition, CXO Advisory Group discusses a piece by Lyandres, Sun and Zhang, titled "The New Issues Puzzle: Testing the Investment-Based Explanation". It argues that corporate investments patterns should be included when constructing benchmark returns (because issuing firms invest more than non-issuers). Once they do, much of the long-term underperformance for these firjms dissappears.

23 Kasım 2006 Perşembe

Dia de Gracia

Feliz Dia de Gracia.

I like the Spanish name for this holiday, because it shows this is a celebration of Grace, of Gratis. You can't feel Gratitude for something that you "earned". Gratitude is the sense of unmerited favor, of Gift, and every particle of the Universe, outside our money-mind system, runs on, by, and through Gratitude. Look into any wild creature's eyes and see its burning fire for yourself.

I'm all excited. Somebody left me a comment with this link: www.utterpants.co.uk/notpants/madmoney.html, which I just added to the link bar to the right.

It's a blog entry I've been wanting to write, and now I don't have to do it because this Michael Dickinson already did, and I couldn't have written it better! You gotta read it, and you'll see these ideas on money aren't my own hair-brain ideas or opinions, but a universal truth that another witness is tapping into.

.............................

A Message for Materialists/Scientists

Now I want to write from a "materialistic" viewpoint, this time not for folks who follow the religion of Evangelical Christianity, but for folks who follow the religion of science and materialism.

So you believe that we all came about by chance, that the universe is a hodge-podge of random reactions. So you believe that Natural Selection brought us from an amoeboid to a rodentoid to an ape-oid to a homo sapiens. This is a fine and true religion. It is the result of simple observation, just as the ancient faiths are. And I maintain that if everybody in the world but believed (practiced) their own religion of simple observation, our world would fall back into balance with the rest of Nature, and we individuals would fall back into balance with our own natures. But let me point out that you most likely do not believe your own religion of science, just as most self-proclaimed Buddhists, Orthodox Christians, Mormons, Muslims, Hindus, Taoists, Sikhs, etc. do not believe their own religion.

Simply put, faith is abandoning yourself to chance. Chance is the random interactions of credit & debt, positive & negative, outside human mind control. If you believe Chance brought us from a dust particle to a human, brought us thus far, why do you now not trust Chance to carry us further??? Why can't we trust that balance will occur if we but give up consciousness of credit & debt, if we but give up control of balance of positive & negative? When has a negative charge ever NOT been naturally met by an equal and opposite positive charge? When has a death ever NOT been naturally met by an equal and opposite life? Why do we continue to not trust that a "bad" deed is naturally met by an equal and opposite "punishment"? Why can't we, who call ourselves scientists, trust our own science, like an infant, that "Vengeance belongs to Chance, Chance will repay", not to our minds that can't even balance a budget. Why can't we trust that Nature is perfectly Just. When have wave crests ever NOT been met by equal and opposite wave troughs? If Female were not met miraculously by an equal and opposite Male, then life would cease. A positive coincides with a negative. If Coincidence ceased, the Universe would cease. Why do we think Coincidence, called Miracle by the religious, is an exception, rather than The Rule?

The Money World Blocks Evolution

Now I'm going to say some seemingly hard things. But you know they are true. Money and possessions side-step chance, putting a block on Evolution, skirting around Natural Selection. We think we are avoiding Death by accumulating money and possessions, by stockpiling positives and squelching negatives. But all we are doing is building up our own demise. The negatives will come back on us in a tidal wave, to bring themselves back into Justice with the positives we've horded. Isn't this what the Koran keeps saying? Isn't this a theme of the Bible and the Dao De Jing? Isn't this basic science?

Why are we as a species nursing prolonged suffering from year to year, generation to generation, in the name of compassion, while Nature abhors prolonged suffering, knocking it off in Just Natural Selection before it can even establish itself? Mutations are naturally balanced with Order in the Wild World. But they are heaped up in massive imbalance in our Domestic World. And we pass them down, in ever larger masses, from generation to generation. Then people like Adolph Hitler arise and think they can re-establish the Balance, and they make it way worse. The erroneously call it Social Darwinism - but Darwinism it is NOT. Darwinism is Natural Selection, not Human Mind-Control Selection. Darwinism is Faith in the Law of Nature, not faith in the laws of human mind-control.

Hunter-Gatherers Our Example

I like how the Inuits (Eskimos) of the past (and maybe still the present) lived in such balance with Nature, that when one became old and too lame to be happy, to contribute to the tribe, she would voluntarily go sit on an ice float cross-legged like the Buddha and wait for a polar bear to eat her up. Missionaries thought this barbaric and put an official end to the practice. Now the Inuits are so happy with their booze and chronic illness and their oil money. When you read accounts of anthropologists who studied the Inuits before Missionary money "saved" them, they are totally astounded how these tribes living in one of the harshest environments on earth could be so constantly happy.

The Kung (Bushmen) of the Kalahari, like the Inuits, lived in another of the harshest environments on earth. The Kalahari doesn't even have regular surface water, and the Kung only carried bows & arrows. The rumor among the civilized was that these Bushmen were poor souls continually suffering, slaving, scratching out a living from the harsh desert. Then anthropologists went in to study them, and were astounded. The Kung were, in fact, the most studied of all hunting-and-gathering tribes. And anthropologists found that they only worked 2 to 3 hours a day, and the rest of the time they spent in leisure. But even that is bogus, because I can testify that when you live without money, there is no distinction between work and play. Watch any wild animal and you'll know what I mean. Don't watch money-funded propaganda nature flicks on TV if you want an accurate view. Go out and see for yourself.

Slaves of Civilization are struggling and suffering, not for food, but to maintain possessions and fictional bank accounts and appearances. And such slaves can't imagine that life could be any other way, so they believe nature is cruel to justify their own cruelty against both themselves and others.

Yet, I Am Not a Primitivist!

I am not really a primitivist. Human inventions come from the same Creative Source as leaves and flowers and chimpanzees and electrons come. Do you know who invented the automobile, the television, the microchip, the rocket, the piano, the paintbrush, the wheel? Chances are you don't. But you know who got famous marketing each of those things and pushing them like drugs for profit, don't you? I had this realization once when I worked at a homeless shelter in Boulder, Colorado. One of the residents was an inventor of machine parts. Presently, he was working on a better sewing machine bobbin. He was doing it for the pure joy of creating - and you know he wasn't doing it for money or fame. The greatest works of art are in temples, done by the obscure for the obscure, simply for the pure joy of doing. Work and play and creation and reward and joy are all One in the Present Moment.

Last summer I talked with a Nepalese Buddhist in Portland, Oregon about these ideas on living moneyless. He got all excited and immediately started envisioning people building cars purely because they wanted to, making computers from a place of pure joy, building cities from instinctual creativity - all within a purely gift economy. Nobody owns anything and all things are shared. And everything balances out as in Nature, because our true selves are Nature. He had the look of a child as he envisioned this "naive" world. Naivete is our only salvation. All great things begin with the "impossible" vision. With faith all things are possible.

I like the Spanish name for this holiday, because it shows this is a celebration of Grace, of Gratis. You can't feel Gratitude for something that you "earned". Gratitude is the sense of unmerited favor, of Gift, and every particle of the Universe, outside our money-mind system, runs on, by, and through Gratitude. Look into any wild creature's eyes and see its burning fire for yourself.

I'm all excited. Somebody left me a comment with this link: www.utterpants.co.uk/notpants/madmoney.html, which I just added to the link bar to the right.

It's a blog entry I've been wanting to write, and now I don't have to do it because this Michael Dickinson already did, and I couldn't have written it better! You gotta read it, and you'll see these ideas on money aren't my own hair-brain ideas or opinions, but a universal truth that another witness is tapping into.

.............................

A Message for Materialists/Scientists

Now I want to write from a "materialistic" viewpoint, this time not for folks who follow the religion of Evangelical Christianity, but for folks who follow the religion of science and materialism.

So you believe that we all came about by chance, that the universe is a hodge-podge of random reactions. So you believe that Natural Selection brought us from an amoeboid to a rodentoid to an ape-oid to a homo sapiens. This is a fine and true religion. It is the result of simple observation, just as the ancient faiths are. And I maintain that if everybody in the world but believed (practiced) their own religion of simple observation, our world would fall back into balance with the rest of Nature, and we individuals would fall back into balance with our own natures. But let me point out that you most likely do not believe your own religion of science, just as most self-proclaimed Buddhists, Orthodox Christians, Mormons, Muslims, Hindus, Taoists, Sikhs, etc. do not believe their own religion.

Simply put, faith is abandoning yourself to chance. Chance is the random interactions of credit & debt, positive & negative, outside human mind control. If you believe Chance brought us from a dust particle to a human, brought us thus far, why do you now not trust Chance to carry us further??? Why can't we trust that balance will occur if we but give up consciousness of credit & debt, if we but give up control of balance of positive & negative? When has a negative charge ever NOT been naturally met by an equal and opposite positive charge? When has a death ever NOT been naturally met by an equal and opposite life? Why do we continue to not trust that a "bad" deed is naturally met by an equal and opposite "punishment"? Why can't we, who call ourselves scientists, trust our own science, like an infant, that "Vengeance belongs to Chance, Chance will repay", not to our minds that can't even balance a budget. Why can't we trust that Nature is perfectly Just. When have wave crests ever NOT been met by equal and opposite wave troughs? If Female were not met miraculously by an equal and opposite Male, then life would cease. A positive coincides with a negative. If Coincidence ceased, the Universe would cease. Why do we think Coincidence, called Miracle by the religious, is an exception, rather than The Rule?

The Money World Blocks Evolution

Now I'm going to say some seemingly hard things. But you know they are true. Money and possessions side-step chance, putting a block on Evolution, skirting around Natural Selection. We think we are avoiding Death by accumulating money and possessions, by stockpiling positives and squelching negatives. But all we are doing is building up our own demise. The negatives will come back on us in a tidal wave, to bring themselves back into Justice with the positives we've horded. Isn't this what the Koran keeps saying? Isn't this a theme of the Bible and the Dao De Jing? Isn't this basic science?

Why are we as a species nursing prolonged suffering from year to year, generation to generation, in the name of compassion, while Nature abhors prolonged suffering, knocking it off in Just Natural Selection before it can even establish itself? Mutations are naturally balanced with Order in the Wild World. But they are heaped up in massive imbalance in our Domestic World. And we pass them down, in ever larger masses, from generation to generation. Then people like Adolph Hitler arise and think they can re-establish the Balance, and they make it way worse. The erroneously call it Social Darwinism - but Darwinism it is NOT. Darwinism is Natural Selection, not Human Mind-Control Selection. Darwinism is Faith in the Law of Nature, not faith in the laws of human mind-control.

Hunter-Gatherers Our Example

I like how the Inuits (Eskimos) of the past (and maybe still the present) lived in such balance with Nature, that when one became old and too lame to be happy, to contribute to the tribe, she would voluntarily go sit on an ice float cross-legged like the Buddha and wait for a polar bear to eat her up. Missionaries thought this barbaric and put an official end to the practice. Now the Inuits are so happy with their booze and chronic illness and their oil money. When you read accounts of anthropologists who studied the Inuits before Missionary money "saved" them, they are totally astounded how these tribes living in one of the harshest environments on earth could be so constantly happy.

The Kung (Bushmen) of the Kalahari, like the Inuits, lived in another of the harshest environments on earth. The Kalahari doesn't even have regular surface water, and the Kung only carried bows & arrows. The rumor among the civilized was that these Bushmen were poor souls continually suffering, slaving, scratching out a living from the harsh desert. Then anthropologists went in to study them, and were astounded. The Kung were, in fact, the most studied of all hunting-and-gathering tribes. And anthropologists found that they only worked 2 to 3 hours a day, and the rest of the time they spent in leisure. But even that is bogus, because I can testify that when you live without money, there is no distinction between work and play. Watch any wild animal and you'll know what I mean. Don't watch money-funded propaganda nature flicks on TV if you want an accurate view. Go out and see for yourself.

Slaves of Civilization are struggling and suffering, not for food, but to maintain possessions and fictional bank accounts and appearances. And such slaves can't imagine that life could be any other way, so they believe nature is cruel to justify their own cruelty against both themselves and others.

Yet, I Am Not a Primitivist!

I am not really a primitivist. Human inventions come from the same Creative Source as leaves and flowers and chimpanzees and electrons come. Do you know who invented the automobile, the television, the microchip, the rocket, the piano, the paintbrush, the wheel? Chances are you don't. But you know who got famous marketing each of those things and pushing them like drugs for profit, don't you? I had this realization once when I worked at a homeless shelter in Boulder, Colorado. One of the residents was an inventor of machine parts. Presently, he was working on a better sewing machine bobbin. He was doing it for the pure joy of creating - and you know he wasn't doing it for money or fame. The greatest works of art are in temples, done by the obscure for the obscure, simply for the pure joy of doing. Work and play and creation and reward and joy are all One in the Present Moment.

Last summer I talked with a Nepalese Buddhist in Portland, Oregon about these ideas on living moneyless. He got all excited and immediately started envisioning people building cars purely because they wanted to, making computers from a place of pure joy, building cities from instinctual creativity - all within a purely gift economy. Nobody owns anything and all things are shared. And everything balances out as in Nature, because our true selves are Nature. He had the look of a child as he envisioned this "naive" world. Naivete is our only salvation. All great things begin with the "impossible" vision. With faith all things are possible.

22 Kasım 2006 Çarşamba

It's Always Christmas Time For Visa (video)

I'm usually not a fan of more legislation, but this one even I have a hard time being against.

One of my readers sent this link to Consumer's Union (the non-profit publisher of Consumer Reports). They're trying to encourage legislators to make credit card disclosures more transparent, and to rein in some of the more abusive credit card company practices.

They've got a great short animated video titled "It's Always Christmas Time For Visa". Check it out.

Then sign the petition, if you're so inclined.

One of my readers sent this link to Consumer's Union (the non-profit publisher of Consumer Reports). They're trying to encourage legislators to make credit card disclosures more transparent, and to rein in some of the more abusive credit card company practices.

They've got a great short animated video titled "It's Always Christmas Time For Visa". Check it out.

Then sign the petition, if you're so inclined.

21 Kasım 2006 Salı

It's a Research Day

It's a research day today. I have an exam tonight (and an alternate one earlier for those students who can't or don't want to take it tonight), so there's no teaching on the table today (except for the last-minute tide of panicked students who'll show up at my office). So, since I'm going in a bit later, I thought I'd put something up on the blog.

On today's research menu:

On today's research menu:

- I have to get data to a student at my former school (I sit on her dissertation committee). As I mentioned before, she knew I was coming here, so she chose her topic to take advantage of the new resources I'd have access to (pretty smart on her part). So, I'll pull some of the data from the big Hansen data set and send it to her.

- I'm still editing a paper that my coaters have send me. One knows the literature in the area phenomenally well (she's written a book), and the other's doing the empirical part. But I'm the only one who speaks (and writes) English as a cradle language. So I get to be the editor. They've actually written a very good first draft (as far as the basic story), but it needs polishing. So, I get to be what I call the "grammar & word nerd". I never thought I'd get so much mileage out of having my writing terrorized by nuns in my formative years.

- Finally, I'm pulling data for another project. It involves merging data together from three different databases and then sending it off to my coauthors for further torture. We got the idea at a recent conference when the three of us had a few beers one night - they were colleagues of a classmate of mine, and I knew them only in passing. But that's the great thing about conferences (and having a few beers) - you start talking and the ideas start flowing. And before you know it, you have a new research project.

Corporate Dealmaker highlights a study by investment bank Houlihan Lokey.Enough bloggery - it's time to head in to the office and get some research done. I've got data (and the English language) to torture!

The study finds that termination fees in mergers are slightly lower than they were in previous years. If it's a continuing trend (and not driven by a few data points), it might make for a good research topic -- it could have a lot of implications for the corporate control market.

Everyone's Illusion (a relatively new blog that looks like it's worth checking out) has a great, short post on hedge funds, tail risk, and loss aversion.

This week's Carnival of The Capitalists is up at Gongol. Posts of note include The Big Picture with links to the most influential of Milton Friedman's works

and James Hamilton of Econbrowser on how the yield curve indicates slower growth ahead but less chance of a recession.

Real Returns reports on a recent trend - share buybacks are increasing. He makes a good point-- that buybacks increase EPS even if earnings are flat.

The NY Times has an interesting piece titled Rewriting the Rules for Buyouts. It notes that minority shareholders don't share much in the gains to MBOs. However, one reason for the unequal sharing is that the managers in an MBO take on a great deal of risk. So, they might just be getting compensation for that risk. The article suggests some "cures", but I'm not sure they wouldn't do more harm than good. HT: Jim Mahar at FinanceProfessor.com.

20 Kasım 2006 Pazartesi

When Will I Learn?

I was grading problem sets last night, and I thought, "Man - A Mike's Lemonade would go down pretty well right now". After all, I'd put in several hours of raking leaves (no, they're not done yet, but I have managed to give myself tendinitis in my wrist), spent a couple of hours editing a paper, and the kids were in bed.

And before I go further, I didn't have more than one.

But for some reason, any alcohol in the hour or two before bed messes up my sleep cycle. And I know this from experience. So I woke up at 3:00, and tossed and turned for the next 3 1/2 hours. Of course, today is my long teaching day.

Tomorrow is a research day. I've got a data set I have toget together for a student at my previous school who's working on her dissertation (I'm on her committee). We have the data she needs here at Unknown University version 2.0, but not at U.U. version 1.0 (in fact, since we knew I was coming here, the knowledge that I'd have access to the data was a major determinant in her choosing the topic). So, I'll make a cut of the data set and send it to her and she takes it from there.

I've also got an exam to give at 6:30, and the early version of the same at 3:00. So I'll be around all day (and evening).

In other words, I'll need breaks. So I'll post more tomorrow. For now, I'm going to bed.

Without Lemonade.

And before I go further, I didn't have more than one.

But for some reason, any alcohol in the hour or two before bed messes up my sleep cycle. And I know this from experience. So I woke up at 3:00, and tossed and turned for the next 3 1/2 hours. Of course, today is my long teaching day.

Tomorrow is a research day. I've got a data set I have toget together for a student at my previous school who's working on her dissertation (I'm on her committee). We have the data she needs here at Unknown University version 2.0, but not at U.U. version 1.0 (in fact, since we knew I was coming here, the knowledge that I'd have access to the data was a major determinant in her choosing the topic). So, I'll make a cut of the data set and send it to her and she takes it from there.

I've also got an exam to give at 6:30, and the early version of the same at 3:00. So I'll be around all day (and evening).

In other words, I'll need breaks. So I'll post more tomorrow. For now, I'm going to bed.

Without Lemonade.

18 Kasım 2006 Cumartesi

The Now Testament

Another beautiful fall day around Moab.

In a previous blog entry, I wrote of my friends, Gordon & Kay, coming to visit at the end of last May. What I didn't mention is that Gordon came to make a short docu-film on living moneyless. He finished the film, & has an webpage intro & teaser for it, which I finally was able to get into. It's at www.moneylessinmoab.com. The music it starts with is some jamming I did on the "Freenotes", which are pentatonic-scale xylophones installed in a park in Moab that anybody can bang on - thanks to Moab's very own Richard Cook, who installed them years ago. Of course, free music on free instruments on public land is right down my alley.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FOR EVANGELICAL CHRISTIANS:

Okay, now, this is written for Evangelical Christians, and has a lot of Bible-quoting. It's my "95 Theses" I'm tacking to the Evangelical church door, challenging the very foundations of this institution:

The Word

It's been a quiet & exhilerating last few days in the canyon. You know, when you become still, and all thoughts & words leave your mind, this is when you find that the same Indescribable Calm that is within you is the same Indescribable Calm that upholds all of Nature. Your mind cannot see reality until all words, all thoughts cease, and your mind becomes like a child's - a blank slate. You don't see things through the filter of judgement, of words, but just as it is. You see that words do not reveal Reality, but veil it. With words you believe in God. But without them you know God. "Be still and know that I am God," the Psalms say. And you see that this Indescribable Calm is the Source, like a Seed, from which all forms of Nature sprout, and to which all forms return again. And these forms of Nature are no different than the thoughts & imaginations that arise spontaneously in your mind. It's an exhilerating realization. Yet words & imagination can never, ever grasp it. You can never, ever grasp God, Reality, with thoughts, with words, with imagination.

"Eye has not seen, nor ear heard,

Nor have entered into the heart of man

The things which God has prepared for those who love Him."

(1 Corinthians 2:9)

Now, looking within to this Law written on your heart, this is where you see that the very Heart of Christianity is the very Heart of Buddhism is the very Heart of Hinduism is the very Heart of Islam.

Because this Calm is beyond time & beyond possession, it cannot be contained in human memory. All we have are words, messengers, that tell us about it, but the words, messengers are not it.

Yet, how can I tell you about this No-thought if there isn't one point of contact between No-thought and thoughts, between No-word and words? There must be one Single Word that mediates between words and no-words, between Heaven & Earth, God & Human, Reality & Illusion, no? It's like the very infinitesimally sharp tip of a pyramid that goes from stone to no-stone, into the sky. It is the very Chief Capstone. It is the One Word that mediates between Reality and Thought (Illusion), that is both Reality and Thought - both Reality and Illusion. In the beginning was the Word, and the Word was with Reality, and the Word was Reality. . . . And the Word became illusion and dwelt among us illusions. When you discover the Infinite Calm of No-Thought, something drives you back to the world of thoughts. It is a desire to take the message to others. Perfect No Thought becomes imperfect thought, that it may gather up all of us who are lost in thoughts and bring us back to No-Thought. Our minds are lost in thoughts, and all we like sheep are gone astray from the Eternal Present (YHWH). So the Eternal Present (YHWH) becomes illusion in search of us, to draw us back. Buddhist masters know exactly what I am talking about. The Buddha, from the sense of Eternal Compassion, relinquishes Nirvana to go back as the Bodhisattva to gather up all of us souls lost in thought.

This is the One Word, One Mediator, between Eternity and Time (Kosmos, illusion). If you look within, you will know what I am saying.

"Do you not know yourselves, that Jesus Christ is in you?"

(2 Corinthians 13:5)

Professed Christians look in the past and in the future and up in heaven for Christ & the Kingdom of God and the End of Time, but never within, never Here & Now. Having been raised Evangelical Christian, I know that most Evangelicals are obsessed with Jesus in the past and Jesus in the future; and they are obsessed with proving past creation of the world and future end of the world. They love everything but the Present.

"Then He also said to the multitudes, "Whenever you see a cloud rising out of the west, immediately you say, 'A shower is coming'; and so it is. And when you see the south wind blow, you say, 'There will be hot weather'; and there is. Hypocrites! You can discern the face of the sky and of the earth, but how is it you do not discern this present moment? Yes, and why, even of yourselves, do you not judge what is right?" (Luke 12:54-57)

"Now when He was asked by the Pharisees when the kingdom of God would come, He answered them and said, "The kingdom of God does not come with observation; nor will they say, 'See here!' or 'See there!' For indeed, the kingdom of God is within you."

Then He said to the disciples, "The days will come when you will desire to see one of the days of the Son of Man, and you will not see it. And they will say to you, 'Look here!' or 'Look there!' Do not go after them or follow them. For as the lightning that flashes out of one part under heaven shines to the other part under heaven, so also the Son of Man will be in His day. (Luke 17:20-24)

The Love of Money, the Worship of the Letter, the Idolatry of Evangelical Christianity

Now we come back to the subject of Money. Money represents things past, things future, but never the Present. Images represent things past, things future, but never the Present. Words represent things past, things future, but never the Present. These words you are reading right now are illusions, unless you can't read. Covetousness (Greed) and Idolatry are one and the same, according to the Bible (Colossians 3:5, Ephesians 5:5). Idolatry is clinging to illusion, image. Idolatry is the mind lost from the Present, and is the root of all evil.

Evangelicals believe that the Bible is the inerrant Word of God, and that to question this is sin. And we were told that there is no salvation apart from the Bible, just as fundamentalist Muslims believe about the Koran. From a child, I was quoted this verse, to show that faith comes by the Bible:

"Faith comes by hearing, and hearing by the word of God." (Romans 10:17)

But then one day I actually looked up the context and it blew me away:

So then faith comes by hearing, and hearing by the word of God.

But I say, have they not heard? Yes indeed:

"Their sound has gone out to all the earth,

And their words to the ends of the world."

(Romans 10:17-18, quoting Psalm 19:4)

Then I looked up the quoted Psalm 19 to get a clearer picture of what this "Word of God" really is:

"The heavens declare the glory of God;

And the firmament shows His handiwork.

Day unto day utters speech,

And night unto night reveals knowledge.

There is no speech nor language

Their voice is not heard.

Their line has gone out through all the earth,

And their words to the end of the world."

(Psalm 19:1-4)

Whoa! I thought, all my life I've been taught that this "Word of God" is the Bible, when the Bible itself says that this "Word of God" is not a book, but is the Utterance of Nature, beyond speech, language, and voice, and this Word is spoken to all the world!

All Evangelicals are also taught these words of Jesus:

"And this gospel of the kingdom shall be preached in all the world for a witness unto all nations; and then shall the end come." (Matthew 24:14)

This is why Evangelicals want to get the Gospel out to the ends of the earth, so that this world will end. And Jesus also states:

"Go into all the world and preach the gospel to every creature". (Mark 16:5)

But then we have this verse:

"This is the gospel that you heard and that has been proclaimed to every creature under heaven" (Colossians 1:23)

The Gospel already has been preached to every creature? And Jesus said the end would come when this happened? Then I looked up the original Greek word for creature. It is ktisis, which means every created thing! How on earth can a human preach human words to every created thing, every rock, every clod of dirt, every robin, every atom??? And how is it that the Psalms keep speaking of the heavens & earth and everything in them hearing the word of God? And how is it that the Psalms speak of the heavens & earth & everything in them singing praises to God? Hello... somebody look up the word animism.

According to the very Bible, this is the Gospel According to Nature, not a book.

The New Testament

When I say New Testament, don't you think of a book written with ink on paper? But this is not what the Bible says the New Testament is. Look up all occurences of New Testament (New Covenant) in the Bible, and see what I mean.

"You are our epistle written in our hearts, known and read by all persons; clearly you are an epistle of Christ, ministered by us, written not with ink but by the Spirit of the living God, not on tablets of stone but on tablets of flesh, that is, of the heart. And we have such trust through Christ toward God. Not that we are sufficient of ourselves to think of anything as being from ourselves, but our sufficiency is from God, who also made us sufficient as ministers of the New Testament, not of the letter but of the *Spirit; for the letter kills, but the Spirit gives life." (2 Corinthians 3: 1-6)

The first mention of the word New Testament is in "The Old Testament" book of Jeremiah (31:31-34). And this passage is quoted in the "New Testament" book of Hebrews (8:7-8). It says that this New Testament is not written with letters, but on the heart. It is the Law of the Heart. And this, Hebrews states, is the goal of Christ, to bring to obsolete the imperfect Old Testament, the letter written with human hands, and bring us the New Testament, the Law written on the heart.

Now what is strange, is that the Bible talks about the Law already written on the hearts of the Gentiles (non-Jews, non-Christians).

"For it is not the hearers of the Law who are just before God, but the doers of the Law will be justified. For when Gentiles who do not have the Law do instinctively the things of the Law, these, not having the Law, are a law to themselves, in that they show the work of the Law written in their hearts, their conscience bearing witness and their thoughts alternately accusing or else defending them, on the Day when, according to my gospel, God will judge the secrets of men through Christ Jesus." (Romans 2:13-16)

Now we see that the non-religious (Gentiles) already have the law written on their hearts! They already have the New Testament, the Now Testament, which is already preached to every creature and is the end goal of Judaism and Christianity! And in the very end sentence of the above passage, we see that this is happening in the Day of Judgement, the Now, the End of Time!

Yes, New means Now. Both words are of the same root. This is the Now Testament. These words I am writing are Old Testament. As soon as I write, my words are past, they are old. As soon as a word enters my memory, it is a thought, out of the Present, old. All thoughts, all words, all letters, are Old Testament. And all words are illusions which fool us. No words are Reality, except the One Word that cannot be spoken, the One Name that is hallowed. The opening verse of the Tao Te Ching says,

"The way that can be described is not the Eternal Way.

The word that can be spoken is not the Eternal Word."

To say any written words, anywhere, any time, are inerrant and eternal is idolatry. The very core doctrines of Evangelical Christianity are idolatrous, as are the very core doctrines of fundamentalist Islam and Mormonism. And idolatry can produce no truth. Idolatry can only produce destruction. It causes war, environmental degradation, pollution, poverty, and self-righteous bigotry. See for yourselves. Am I wrong? "The letter kills, but the Spirit gives life."

Jesus' message was aimed at the fundamentalist Jews of his day, the Pharisees, who clung to the Bible as their source of salvation, believing it the literal, inerrant Word of God, and who also were "lovers of money". Idolatry & covetousness always go together, for they are one and the same ("Now the Pharisees, who were lovers of money, also heard all these things, and they derided Him." {Luke 16:14}). Now, with new understanding, read what Christ says to these fundamentalists:

"You have neither heard His voice at any time, nor seen His form. But you do not have His word abiding in you, because whom He sent, Him you do not believe. You search the Scriptures, for in them you think you have eternal life; and these are they which testify of Me. But you are not willing to come to Me that you may have life." (John 5:38-40)

Now, if you want to know truth, not just believe truth, you need to turn this computer off and put away these and all words of illusion and find the Stillness within, the Now, the Reality, "the Peace that passes all understanding." It's not enough to believe in God, "Be still and know that I am God."

In a previous blog entry, I wrote of my friends, Gordon & Kay, coming to visit at the end of last May. What I didn't mention is that Gordon came to make a short docu-film on living moneyless. He finished the film, & has an webpage intro & teaser for it, which I finally was able to get into. It's at www.moneylessinmoab.com. The music it starts with is some jamming I did on the "Freenotes", which are pentatonic-scale xylophones installed in a park in Moab that anybody can bang on - thanks to Moab's very own Richard Cook, who installed them years ago. Of course, free music on free instruments on public land is right down my alley.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FOR EVANGELICAL CHRISTIANS:

Okay, now, this is written for Evangelical Christians, and has a lot of Bible-quoting. It's my "95 Theses" I'm tacking to the Evangelical church door, challenging the very foundations of this institution:

The Word

It's been a quiet & exhilerating last few days in the canyon. You know, when you become still, and all thoughts & words leave your mind, this is when you find that the same Indescribable Calm that is within you is the same Indescribable Calm that upholds all of Nature. Your mind cannot see reality until all words, all thoughts cease, and your mind becomes like a child's - a blank slate. You don't see things through the filter of judgement, of words, but just as it is. You see that words do not reveal Reality, but veil it. With words you believe in God. But without them you know God. "Be still and know that I am God," the Psalms say. And you see that this Indescribable Calm is the Source, like a Seed, from which all forms of Nature sprout, and to which all forms return again. And these forms of Nature are no different than the thoughts & imaginations that arise spontaneously in your mind. It's an exhilerating realization. Yet words & imagination can never, ever grasp it. You can never, ever grasp God, Reality, with thoughts, with words, with imagination.

"Eye has not seen, nor ear heard,

Nor have entered into the heart of man

The things which God has prepared for those who love Him."

(1 Corinthians 2:9)

Now, looking within to this Law written on your heart, this is where you see that the very Heart of Christianity is the very Heart of Buddhism is the very Heart of Hinduism is the very Heart of Islam.

Because this Calm is beyond time & beyond possession, it cannot be contained in human memory. All we have are words, messengers, that tell us about it, but the words, messengers are not it.

Yet, how can I tell you about this No-thought if there isn't one point of contact between No-thought and thoughts, between No-word and words? There must be one Single Word that mediates between words and no-words, between Heaven & Earth, God & Human, Reality & Illusion, no? It's like the very infinitesimally sharp tip of a pyramid that goes from stone to no-stone, into the sky. It is the very Chief Capstone. It is the One Word that mediates between Reality and Thought (Illusion), that is both Reality and Thought - both Reality and Illusion. In the beginning was the Word, and the Word was with Reality, and the Word was Reality. . . . And the Word became illusion and dwelt among us illusions. When you discover the Infinite Calm of No-Thought, something drives you back to the world of thoughts. It is a desire to take the message to others. Perfect No Thought becomes imperfect thought, that it may gather up all of us who are lost in thoughts and bring us back to No-Thought. Our minds are lost in thoughts, and all we like sheep are gone astray from the Eternal Present (YHWH). So the Eternal Present (YHWH) becomes illusion in search of us, to draw us back. Buddhist masters know exactly what I am talking about. The Buddha, from the sense of Eternal Compassion, relinquishes Nirvana to go back as the Bodhisattva to gather up all of us souls lost in thought.

This is the One Word, One Mediator, between Eternity and Time (Kosmos, illusion). If you look within, you will know what I am saying.

"Do you not know yourselves, that Jesus Christ is in you?"

(2 Corinthians 13:5)

Professed Christians look in the past and in the future and up in heaven for Christ & the Kingdom of God and the End of Time, but never within, never Here & Now. Having been raised Evangelical Christian, I know that most Evangelicals are obsessed with Jesus in the past and Jesus in the future; and they are obsessed with proving past creation of the world and future end of the world. They love everything but the Present.

"Then He also said to the multitudes, "Whenever you see a cloud rising out of the west, immediately you say, 'A shower is coming'; and so it is. And when you see the south wind blow, you say, 'There will be hot weather'; and there is. Hypocrites! You can discern the face of the sky and of the earth, but how is it you do not discern this present moment? Yes, and why, even of yourselves, do you not judge what is right?" (Luke 12:54-57)

"Now when He was asked by the Pharisees when the kingdom of God would come, He answered them and said, "The kingdom of God does not come with observation; nor will they say, 'See here!' or 'See there!' For indeed, the kingdom of God is within you."

Then He said to the disciples, "The days will come when you will desire to see one of the days of the Son of Man, and you will not see it. And they will say to you, 'Look here!' or 'Look there!' Do not go after them or follow them. For as the lightning that flashes out of one part under heaven shines to the other part under heaven, so also the Son of Man will be in His day. (Luke 17:20-24)

The Love of Money, the Worship of the Letter, the Idolatry of Evangelical Christianity

Now we come back to the subject of Money. Money represents things past, things future, but never the Present. Images represent things past, things future, but never the Present. Words represent things past, things future, but never the Present. These words you are reading right now are illusions, unless you can't read. Covetousness (Greed) and Idolatry are one and the same, according to the Bible (Colossians 3:5, Ephesians 5:5). Idolatry is clinging to illusion, image. Idolatry is the mind lost from the Present, and is the root of all evil.

Evangelicals believe that the Bible is the inerrant Word of God, and that to question this is sin. And we were told that there is no salvation apart from the Bible, just as fundamentalist Muslims believe about the Koran. From a child, I was quoted this verse, to show that faith comes by the Bible:

"Faith comes by hearing, and hearing by the word of God." (Romans 10:17)

But then one day I actually looked up the context and it blew me away:

So then faith comes by hearing, and hearing by the word of God.

But I say, have they not heard? Yes indeed:

"Their sound has gone out to all the earth,

And their words to the ends of the world."

(Romans 10:17-18, quoting Psalm 19:4)

Then I looked up the quoted Psalm 19 to get a clearer picture of what this "Word of God" really is:

"The heavens declare the glory of God;

And the firmament shows His handiwork.

Day unto day utters speech,

And night unto night reveals knowledge.

There is no speech nor language

Their voice is not heard.

Their line has gone out through all the earth,

And their words to the end of the world."

(Psalm 19:1-4)

Whoa! I thought, all my life I've been taught that this "Word of God" is the Bible, when the Bible itself says that this "Word of God" is not a book, but is the Utterance of Nature, beyond speech, language, and voice, and this Word is spoken to all the world!

All Evangelicals are also taught these words of Jesus:

"And this gospel of the kingdom shall be preached in all the world for a witness unto all nations; and then shall the end come." (Matthew 24:14)

This is why Evangelicals want to get the Gospel out to the ends of the earth, so that this world will end. And Jesus also states:

"Go into all the world and preach the gospel to every creature". (Mark 16:5)

But then we have this verse:

"This is the gospel that you heard and that has been proclaimed to every creature under heaven" (Colossians 1:23)

The Gospel already has been preached to every creature? And Jesus said the end would come when this happened? Then I looked up the original Greek word for creature. It is ktisis, which means every created thing! How on earth can a human preach human words to every created thing, every rock, every clod of dirt, every robin, every atom??? And how is it that the Psalms keep speaking of the heavens & earth and everything in them hearing the word of God? And how is it that the Psalms speak of the heavens & earth & everything in them singing praises to God? Hello... somebody look up the word animism.

According to the very Bible, this is the Gospel According to Nature, not a book.

The New Testament

When I say New Testament, don't you think of a book written with ink on paper? But this is not what the Bible says the New Testament is. Look up all occurences of New Testament (New Covenant) in the Bible, and see what I mean.

"You are our epistle written in our hearts, known and read by all persons; clearly you are an epistle of Christ, ministered by us, written not with ink but by the Spirit of the living God, not on tablets of stone but on tablets of flesh, that is, of the heart. And we have such trust through Christ toward God. Not that we are sufficient of ourselves to think of anything as being from ourselves, but our sufficiency is from God, who also made us sufficient as ministers of the New Testament, not of the letter but of the *Spirit; for the letter kills, but the Spirit gives life." (2 Corinthians 3: 1-6)

The first mention of the word New Testament is in "The Old Testament" book of Jeremiah (31:31-34). And this passage is quoted in the "New Testament" book of Hebrews (8:7-8). It says that this New Testament is not written with letters, but on the heart. It is the Law of the Heart. And this, Hebrews states, is the goal of Christ, to bring to obsolete the imperfect Old Testament, the letter written with human hands, and bring us the New Testament, the Law written on the heart.

Now what is strange, is that the Bible talks about the Law already written on the hearts of the Gentiles (non-Jews, non-Christians).

"For it is not the hearers of the Law who are just before God, but the doers of the Law will be justified. For when Gentiles who do not have the Law do instinctively the things of the Law, these, not having the Law, are a law to themselves, in that they show the work of the Law written in their hearts, their conscience bearing witness and their thoughts alternately accusing or else defending them, on the Day when, according to my gospel, God will judge the secrets of men through Christ Jesus." (Romans 2:13-16)

Now we see that the non-religious (Gentiles) already have the law written on their hearts! They already have the New Testament, the Now Testament, which is already preached to every creature and is the end goal of Judaism and Christianity! And in the very end sentence of the above passage, we see that this is happening in the Day of Judgement, the Now, the End of Time!

Yes, New means Now. Both words are of the same root. This is the Now Testament. These words I am writing are Old Testament. As soon as I write, my words are past, they are old. As soon as a word enters my memory, it is a thought, out of the Present, old. All thoughts, all words, all letters, are Old Testament. And all words are illusions which fool us. No words are Reality, except the One Word that cannot be spoken, the One Name that is hallowed. The opening verse of the Tao Te Ching says,

"The way that can be described is not the Eternal Way.

The word that can be spoken is not the Eternal Word."

To say any written words, anywhere, any time, are inerrant and eternal is idolatry. The very core doctrines of Evangelical Christianity are idolatrous, as are the very core doctrines of fundamentalist Islam and Mormonism. And idolatry can produce no truth. Idolatry can only produce destruction. It causes war, environmental degradation, pollution, poverty, and self-righteous bigotry. See for yourselves. Am I wrong? "The letter kills, but the Spirit gives life."

Jesus' message was aimed at the fundamentalist Jews of his day, the Pharisees, who clung to the Bible as their source of salvation, believing it the literal, inerrant Word of God, and who also were "lovers of money". Idolatry & covetousness always go together, for they are one and the same ("Now the Pharisees, who were lovers of money, also heard all these things, and they derided Him." {Luke 16:14}). Now, with new understanding, read what Christ says to these fundamentalists:

"You have neither heard His voice at any time, nor seen His form. But you do not have His word abiding in you, because whom He sent, Him you do not believe. You search the Scriptures, for in them you think you have eternal life; and these are they which testify of Me. But you are not willing to come to Me that you may have life." (John 5:38-40)

Now, if you want to know truth, not just believe truth, you need to turn this computer off and put away these and all words of illusion and find the Stillness within, the Now, the Reality, "the Peace that passes all understanding." It's not enough to believe in God, "Be still and know that I am God."

17 Kasım 2006 Cuma

TGIF Link Dump

It's the weekend at last. Well, not really, since I have enough work to make it necessary for me to come in to my office Satuday (and probably Sunday, too). But at least classes are done. And next week I have an exam in one class and a review in the other. And then Thanksgiving.

Hopefully, the light schedule for next week will allow me to catch up a bit. The first semester at a new school is always a bit hectic, and this one certainly ran true to form.

In any event, here are today's links:

Hopefully, the light schedule for next week will allow me to catch up a bit. The first semester at a new school is always a bit hectic, and this one certainly ran true to form.

In any event, here are today's links:

CXO Advisory group reviews some academic research on "synthetic hedge funds"Enough blogging. Back to research or no soup for you!

JLP at AllFinancialMatters has a short tutorial on how to get refreshable stock quotes in an Excell spreadsheet.

The traditional hedge fund compensation is "2 and 20" (i.e. a 2% annual fee of aasets under management and 20% of the profits). The NY Times Online reports on a hedge fund that has a very different compensation structure-0 ti's based on performance over multi-year windows.

The NYT also has another article where they profile a paper by Bebchuck, Grinstein, and Peyer. It indicates that options backdating wasn't just limited to high-tech firms. there was also a lot of it going on at old-line companies. HT: Jim Mahar at Financeprofessor.com.

16 Kasım 2006 Perşembe

Milton Friedman RIP

Nobel Laureate Milton Friedman passed away last night at age 94. He was truly one of the great champions of of our times for both personal and economic freedom. Here's a good piece his obitiuary in the Financial Times:

Read the whole thing here --it gives a very detailed account of his life and work.

We're definitely the poorer for his passing.

Both his admirers and his detractors have pointed out that his world view was essentially simple: a passionate belief in personal freedom combined with a conviction that free markets were the best way of co-ordinating the activities of dispersed individuals to their mutual enrichment. Where he shone was in his ability to derive interesting and unexpected consequences from simple ideas. As I knew from my postbag, part of his appeal lay in his willingness to come out with home truths which had occurred to many other people who had not dared to utter them. Friedman would then go on, however, to defend these maxims against the massed forces of economic correctness; and in the course of those defences he, almost unintentionally, added to knowledge.

We're definitely the poorer for his passing.

15 Kasım 2006 Çarşamba

Wednesday Link Dump

I'm done teaching for the day, but still in the midst of rewriting a paper. So, without further ado, here are some links for your viewing pleasure:

However, if you want more things to read, go amuse yourself with Scott Adams' blog (yes- the creator of Dilbert has a blog). He's even funnier on the blog than in his cartoons.