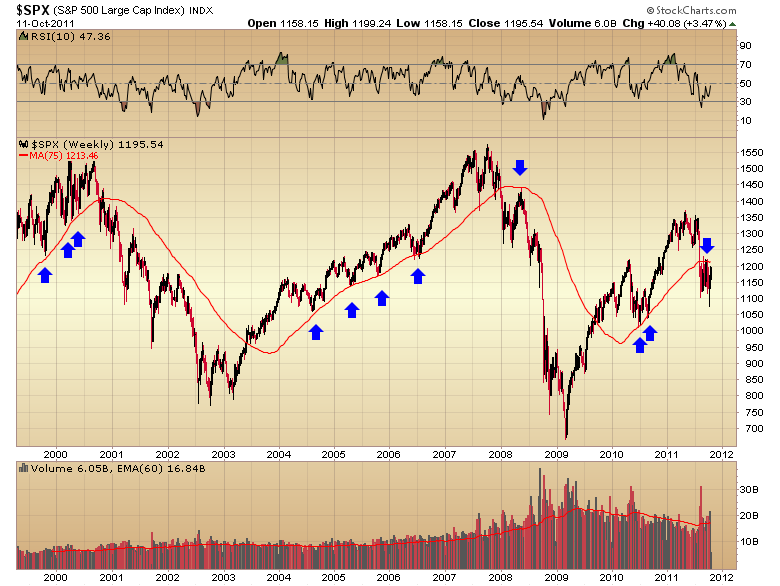

The 75 week moving average has been a very clear dividing line between bull and bear markets for the last couple of decades.

The S&P is on the verge of running in to that roadblock soon.

It's possible that the S&P could penetrate this level briefly, and possibly even rally back to the 200 day moving average (about 1250) before the bear market resumes. That being said I doubt the market will be able to penetrate this major resistance level on the first try, and it may even end up capping this bear market rally.

We already have three warning signs that popped up today that should make bulls wary. More in tonight's report...

Hiç yorum yok:

Yorum Gönder