I'm in Arcata, Cali right now.

If i blogged more often, each entry wouldn't be so verbose. But I'm covering lots of ground over the past month when i get to computers. Also, book writers are verbose. So just think of this as a book online that's for free, since i don't want to publish for money. Okay, paper books are nicer than computer screens. Maybe that'll change.

Huck Finnin'

Lots have been happening since i last wrote here. It turns out i set up a camp on a deserted island in the Willamette River in Portland weeks ago. The island is very wild & pristine, for being surrounded by the chaos of Portland. It's full of deer, beaver, nutrea, otters (i think), blue heron, and bald eagle! And the insects make a haunting, perfectly syncronized, rhythmic hum through the night. There are huge trees & thick foliage, including tons of blackberries, everywhere. At first I was swimming to the island. But the river is kinda sketchy - i mean polluted. And the weather was getting colder; so one night i wasn't feeling too good about having set up camp there. I didn't even want to dip in that water again to swim back, because the water looked particularly scuzzy at that time. And my idea of building a raft was turning out to not be so easy. I had brought a saw to cut huge logs, but it was too small. But then i remembered that it had felt so totally right coming to that island, & that i hadn't come this far to lose faith now. So my mind went from worry to rest in the perfect Random future.

The next morning was glorious, and the sunlight was sparkling on the still Willamette. The river was way low - so low there was a land bridge over to Ross island. I'd never seen it that low, though the river fluctuates like tides every day. I'm still not sure if it's tide changes (this far inland?) or maybe dam-levee adjustments. Whatever, i decided to walk over to Ross island to explore. There are lots of abandoned camps, in plane view on Ross island's beaches. I walked quite a ways on the west beach. I then felt like making a bee-line into the forest & thick foliage, and stumbled upon an old, broken kayak paddle. I could use it for my potential raft, i thought. I left the paddle and walked further down the beach until i saw a strange black thing washed up on the shore. I went to investigate and found it was 8 plastic buoy-like things linked together like a jig-saw puzzle. They had maple leaves on them, so i figured it was something from a Canadian ship. I pushed it into the water & hopped on. It totally floated! So i ran back, got that old paddle, and paddled that raft into the river! I started paddling it back to my island, and just when i was feeling intense gratitude, a bald eagle flew from my left directly across my path.

So i had floaty transpo now. I made a temporary tee-pee type shelter with old lumber & tarps. I've been having visions of making a clay cob structure. But October is when the rainy season starts, and i'm still debating weather or not to stay on the island then.

I Finally Decided to Use a $20 Bill... But I Still Didn't Use Money!

One day when i was exploring Ross island, i stumbled upon a $20 bill on the beach. My custom, since i started to live moneyless 6 years ago, has been to get rid of any money i find or am given by sunrise the next morning. But this time i had planned on staying on the island for a few nights. I thought about floating to the river shore & leaving it someplace random for some random humanoid, & then come right back to the island. But then i realized i was being to bound by the idea of money. The idea is to see things for what they are. The bill was not money. Money was in my head. Money was my belief about the $20 bill, not the $20 bill itself! So i looked at the bill. It was actually quite beautiful, a work of art. That's what it IS! I could evolve its beauty by cutting it up and making it into a collage! So i cut it into pieces. It would be a useful collage, because it would upset people's belief. It would upset the money religion, and maybe jolt some folks back into the Present.

So, are you upset that i cut up a $20 bill? Are you saying, "you could have given it to the poor." If this upsets you, you are a Judas. Remember the story of Judas in the Bible? I want you to recognize that all people who believe in Money are Judases. Now don't judge a Judas as good or bad, just recognize yourself as Judas. Judas is in me, too. Yeah, Judas is also part of the Plan - isn't that what scripture says? When the woman (Mary Magdeline?) took the "costly" ointment in the alabaster box and broke it, pouring it over Jesus' head & feet, Judas was apalled, saying, "This could have been sold and given to the poor!" I believe they say it was a month's wages. In one gospel version, all Jesus' disciples were apalled. Mary Magdeline, though, had the eyes of a child, the Divine Eye, and saw the ointment & the box for what they were, not blinded by Money Religion. All she knew was they were beautiful now. Do you get it? Is your mind simple enough to understand? Is your mind the Buddha mind?

Do you understand that the only way the world can come into balance is to see everything as it IS, not what it coulda woulda shoulda been? Can you stop trying to save the world and simply BE, thus saving the entire Universe? By you I mean me. I'm asking these questions to myself.

"The poor you have with you always", Jesus responded to Judas. This, too, baffles the Money Mind. "Poor" means "bad" to the Money Mind. But have you forgotten that Jesus said, "Blessed are you Poor, for yours is the Kingdom of God". Happy are you Poor. There is no better news than "the poor you have with you always." The Money Mind just doesn't get it. The Buddha Mind is the Poor Mind, the Empty Mind, the Christ Mind, the Child Mind. The infant and the raven and the lilly are Poor, are Blessed.

Bay Area

I had in mind staying & playing on the island & doing Food Not Bombs & other stuff. But Satya asked if i'd go with him to the Bay area where he was taking Indian flute lessons. So off we went. We train-hopped out of Portland in a luxurious engine. We got booted out Klamath Falls. Then we hitched to San Fran. We stayed at the "Chicken House", a kind of co-op house full of young folks. A young woman named Becky there was immediately drawn to Satya and I and took us to a couple of her cool hang-out spots in San Fran, like "Station 40" and "The Commune" and introduced us to her friends. She made us feel right at home.

Then Satya & I parted ways. I went up to Fort Knolls in Marine County to visit my friend Saskia. Saskia is a Dutch woman who devotes her life to animal activism. She often goes to sea with Sea Shepherd to stop illegal whaling, fishing that endangers dolphins, and fur seal hunting. She also has about 8 dogs on her land she rescued from hurricane Katrina aftershock.

After a few days at Saskia's i hooked up with my cousin Lauren, who had just come into the Bay area from Texas to possibly relocate. Lauren wanted to drive a ways to northern Cali to explore and took me to Ukiah. From Ukiah I hitched here to Arcata. I think I'm heading north to Portand again, but plans might be changing.

Ah, the life of Random! Random is the Divine Mind, Natural Selection, that evolved us and continues to do evolve us. Can we give up our worrisome Mind Selection and trust in Natural Selection? I'm still learning to trust, even though Natural Selection keeps proving Grace to me over and over.

So much to talk about, but i've been on this public computer way too long.

30 Eylül 2006 Cumartesi

Snakes On A Birthday Party

The Unknown Wife hung the moon for the Unknown Son's 8th birthday party yesterday.

We took about a dozen of his friends to a nearby place run by a marine biologist from Unknown University. They had tanks with all kinds of crabs, guppy sharks, iguanas, and assorted disgusting looking creatures. Just perfect for an eight year old boy.

The two highlights of his day were:

1) Petting a small (about 18 inches long) shark (it subsequently almost jumped out of the tank, to the kids delight), and

2) Having a 35 lb boa constrictor draped across his shoulders.

This was followed by (of course) pizza, cake and ice cream.

He said it was "the best birthday ever."

We took about a dozen of his friends to a nearby place run by a marine biologist from Unknown University. They had tanks with all kinds of crabs, guppy sharks, iguanas, and assorted disgusting looking creatures. Just perfect for an eight year old boy.

The two highlights of his day were:

1) Petting a small (about 18 inches long) shark (it subsequently almost jumped out of the tank, to the kids delight), and

2) Having a 35 lb boa constrictor draped across his shoulders.

This was followed by (of course) pizza, cake and ice cream.

He said it was "the best birthday ever."

28 Eylül 2006 Perşembe

Friday Link Dump

It's been a busy Friday - I taught a class this morning and saw an excellent presentation in the afternoon on investments in private equity. The paper presented examined the different types of parties (public pension funds, endowments, private pension funds, etc...) that invest in various types of Private Equity funds (i.e. buyout. early-stage VC or late-stage VC). Its main result was that there are significant differences in the ability of different cohorts of investors to make good choices (even within a given asset class). And the presenter did an outstanding job -- it's always fun to see a real professional at work.

And since he came to our campus for the visit, we got a free meal out of it at the university club (and my mouth felt good enough following my surgery that I could enjoy it).

So, today's Link Dump is a bit late (and a bit sparse). But better late than never. So without further ado:

And it's off-site, so we don't have to clean up. So everyone's happy.

And since he came to our campus for the visit, we got a free meal out of it at the university club (and my mouth felt good enough following my surgery that I could enjoy it).

So, today's Link Dump is a bit late (and a bit sparse). But better late than never. So without further ado:

CFO.com provides a good example of the earnings inflation technique known as "channel stuffing"And now, it's off to another birthday party for the Unknown Son. We did the in-family party yesterday, but today's involves the neighborhood kids and his classmates.

Bloomberg.com reports that bondholders have sued Wendy's over the spinoff of their Tim Horton's Unit. The bondholders claim the spinoff will increase the riskiness of the remaining firm, to their detriment. It's a good example to use in class to illustrate the "shareholder-bondholder agency problem."

Dealbook reposts on recent activities of some well-known activist investors.

David Andrew Taylor brings a very nice (and low-tech) explanation of why an inverted yield curve means that bond investors are predicting a recession.

Geoff Gannon at Seeking Alpha gives some background on the Dow. To paraphrase Inigo Montoya, "I don't think that Index is what you think it is."

The New York Times tells us Kobi Alexander isn't pleased with his accommodations in "U.S. Fugitive in Options Case Displeased By His African Jail." Apparently it's not up to "Club Fed" U.S. White -collar crime lodgings standards.

And it's off-site, so we don't have to clean up. So everyone's happy.

Who are My Picks For the Nobel Prize in Economics

Now that the Vicodin has kicked in, I have some time to post a bit. If I'm feeling o.k., I should probably really be working on academic stuff, but this way I can see just how lucid I am before I go back to writing on the current academic project. After I'm done, l'll put it down for a bit, read my latest Terry Pratchett novel, and then come back to see if I made any sense (or at least, as much as I usually do).

In any event, speculation seems to be heating up for who will get the next Nobel Prize in economics. I'll cast my vote for Eugene Fama of the University of Chicago for his earlier work on market efficiency (and later work on size and market-book effects which seem to contradict his earlier work). If he gets the nod, there's a good chance that his coauthor Kenneth French would share it with him.

A second choice would be The U of Chicago's Richard Thaler for his work in advancing the field of behavioral economics. Since we read several of all three authors' papers in grad school, I'd be happy with any of them (but my favorite would be for Fama to get it).

After typing this, I realize that the pain meds have slightly altered my fine muscle control - I keep hitting the wrong keys. Ah well - that's what spell check (and editing) are for.

Update: I rechecked this piece after a nap (and after a bit more of the anesthesia had worn off). Man on man - I made a lot of errors.

Update (10/3): Welcome to all the folks stopping by from Dealbreaker. com -- if you want a little history behind Financial Rounds, check out the FAQ page.

In any event, speculation seems to be heating up for who will get the next Nobel Prize in economics. I'll cast my vote for Eugene Fama of the University of Chicago for his earlier work on market efficiency (and later work on size and market-book effects which seem to contradict his earlier work). If he gets the nod, there's a good chance that his coauthor Kenneth French would share it with him.

A second choice would be The U of Chicago's Richard Thaler for his work in advancing the field of behavioral economics. Since we read several of all three authors' papers in grad school, I'd be happy with any of them (but my favorite would be for Fama to get it).

After typing this, I realize that the pain meds have slightly altered my fine muscle control - I keep hitting the wrong keys. Ah well - that's what spell check (and editing) are for.

Update: I rechecked this piece after a nap (and after a bit more of the anesthesia had worn off). Man on man - I made a lot of errors.

Update (10/3): Welcome to all the folks stopping by from Dealbreaker. com -- if you want a little history behind Financial Rounds, check out the FAQ page.

27 Eylül 2006 Çarşamba

Thursday Link Dump- The Wisdom Tooth Edition

Today I get to have a severely impacted wisdom tooth removed - one of the few things I enjoy less than college-wide faculty meetings (at least I can bring hot coffee and papers to grade to the meetings).

On the other hand (What did you expect? I'm trained as an economist, so there's ALWAYS an "other hand"), they do give me some very nice pharmaceuticals to help me cope with the discomfort. So, I will likely not be blogging much today, and if I do, it might not be very lucid (and no comments about my usual level of lucidity).

So, here's the day's Link Dump):

Update: it wasn't too bad. The actual extraction took about 45 minutes, and I didn't recall a bit once the Verced kicked in. The jaw's sore, but the vicodine seems to be handling that o.k. (except I just failed to enter the verification word 3x to post this).

Anyone like to give odds on whether I make it to my 11:00 lecture tomorrow?

On the other hand (What did you expect? I'm trained as an economist, so there's ALWAYS an "other hand"), they do give me some very nice pharmaceuticals to help me cope with the discomfort. So, I will likely not be blogging much today, and if I do, it might not be very lucid (and no comments about my usual level of lucidity).

So, here's the day's Link Dump):

All About Alpha highlights a paper that attempts to “debunk” several myths about active management.Off to the dentist (groan), and time to be thankful for the wonders of modern pharmacology. In the old days I'd have to make do with a scotch and soda (or two), and this is much more efficient.

Abnormal Returns discusses how there might be insufficient alpha to go around.

Equity Private is yawning over Amaranth.

Chuck Jaffe of Marketwatch highlights some new actively managed ETF offerings, including one based on insider trading patterns.

On Seeking Alpha, Geoff Considine shows how using P/E ratios to screen ETFs doesn't make much sense. He makes some good points about how P/E ratios capture both growth and risk (and the two dimensions are hard to disentangle).

Dan Melson at Searchlight Crusade brings the 411 on buying real estate with 0% down.

Lastly, there were a couple of good Wall Street Journal Articles (online subscription required). In the first, we get the latest episode of "Where's Kobi?" It turns out that they found Kobi Alexander (Comverse Technologies CEO) in Namibia. And he's facing extradition.

In the second article, "Some ETFs start in Europe" we find out that the lighter lighter regulatory burden in Europe has shifted some ETF originatiooverseasrs (kind of like a play opening in New Haven and only later getting to Broadway).

Finally, in this week's "efficient markets aren't" story, the WSJ brings asks "Does Stock By Any Other Name Smell As Sweet?"-- They discuss recent research in the behaviorafinancece vein that indicates that the ease of remembering a company's ticker symbol is associated with its stock market performance. There's also a pretty good picture I'll have to find a way to use in my class somehow.

Update: it wasn't too bad. The actual extraction took about 45 minutes, and I didn't recall a bit once the Verced kicked in. The jaw's sore, but the vicodine seems to be handling that o.k. (except I just failed to enter the verification word 3x to post this).

Anyone like to give odds on whether I make it to my 11:00 lecture tomorrow?

26 Eylül 2006 Salı

Wednesday Link Dump

Not much to link to today, since I'm doing the Link Dump a bit early this time:

From Marketwatch.com: Michael Oxley of Sarbanes Oxley fame believes that changes will be forthcoming in SOX in the near future that will make it less burdensome for small companies. Personally, I'll take a "wait and see" approach, since my experience is that regulators seldom make regulations LESS burdensome.Time for another cuppa Joe and then off to class. I actually do one of my favorite topics today: active vs. passive management, fund fees and index funds.

From yesterday's Online Wall Street Journal, "Merger Trend Sweeping Big Exchanges Cascades Toward 'Interdealer Brokers'"

Abnormal Returns has a great analogy - it compares the evolution of the ease with which investors can get market returns (i.e. with index funds and ETFs) over time with the ease in getting a meal at a high-end restaurant.

Spitzer is at it again - he just sued mutual fund house J&W Seligman. The thought of him as governor of New York just bothers me.

Craig Newmark at Newmark's Door links to this excellent list of logical fallacies.

This Week's Carnival of The Capitalists

I'm a bit late in the announcing, but this week's COTC is up at Crossroads Dispatches. My three picks of of the week are:

Dave Porter at Pacesetter Mortgage Blog asks and answers the question What Do Mortgage Underwriters DO?Enjoy, and look around when you've read these. There's always lots of good stuff at a Carnival.

Free Money Finance shows how mutual fund fees can cost far more than you think., and advises people to buy index funds.

Dan Melman of Searchlight Crusade talks about loans on modular houses.

Tuesday Link Dump

There's lots of interesting stuff since yesterday both in the Mainstream Media and in the Blogosphere. Some of it is actually useful - I realized it was tome to refinance my mortgage (after all, I've been in the house for almost 3 months already. Herr are the latest tidbits:

First, on the lighter side: Did Bin Laden die from eating tainted spinach? Maybe it was a CIA Plot. And one blogger is trying to engage in what can only be called Elmo Arbitrage.Back to work: I've got data to torture and the English language to mangle (that's called "writing papers, for you non-academics...)

MarketWatch.com discusses how a cooling off in the housing market has resulted in a decrease in the rate on the benchmark Treasury rate. After reading it. I just did my refinance on my house (saved about $1,500 a year). For all you finance and econ faculty out there, the piece has a lot Oof good material for illustrating the Fed, interest rates, and inflation.

There's been a bit of insider-trading related news: Dealbook reports on the not-guilty plea by former hedge fund manager Hilary Shane, who allegedly shorted shares just prior to a private offering by Compudyne. And Marketwatch tells us that the SEC is planning to ramp up enforcement of insider trading in concert with self-regulatory organizations like the NASD and NYSE.

Bloomberg News reports on the increase in FBI investigations related to corporate fraud in general and options backdating in particular.

Political Calculations is finally getting around to putting up an index to all the online tools they've created.

Dan Melson at Searchlight Crusade asks (and answers) the question "Should Negative Amortization Loans Be Banned?"

The Daily Options Report talks about changes in automatic exercise provisions for slightly in-the-money options.

Marketwatch.Com reports on how the SEC is revamping Edgar (their online system for looking up filing information). I was just using it about an hour ago, and it can definitely use a more user-friendly system.

And last, but not least, Jim Mahar at FinanceProfessor.com discusses financial risk management (specifically, fuel hedging by airlines).

25 Eylül 2006 Pazartesi

50,000 Hits For Financial Rounds

I just looked at my sitemeter, and Financial Rounds received its 50,000th hit sometime this afternoon. I'm pleased and humbled.

Thanks to all of you who've stopped by (and even more, came back) over the last 19 months or so.

When I started this thing (on a whim) in February of 2005 I never imagined I'd have so many visitors. I realize I'm a relatively small fry in the grand scheme of things, but I'm extremely happy with these results.

Thanks to all of you who've stopped by (and even more, came back) over the last 19 months or so.

When I started this thing (on a whim) in February of 2005 I never imagined I'd have so many visitors. I realize I'm a relatively small fry in the grand scheme of things, but I'm extremely happy with these results.

Monday Link Dump

It's another new week at Unknown University, and I have a quiz to give my class in about an hour. So, without further ado, here's the latest link dump:

So it must be time to get to work.

Marketwatch.com speculates on whether the recent Amaranth failure will affect institutional demand for hedge funds.Ah well, enough bloggery for now. My Bloglines account is now empty, and the large coffee I had before coming to the office just hit my third brain cell.

Saturday's Wall Street Journal (online subscription required) reports on a possible trend towards less levered LBOs (maybe Equity Private can come up with a new name for these transactions).

Bloomberg.com discusses an article by Venkataram and Besseembinder in the Journal of Financial Economics. It shows that the increased transparency in the bond markets resulting from the implementation of the Trace system has cost bond traders about $1 billion in profits over the last year.

Calculated Risk points to a very interesting BusinessWeek article on mortgage buybacks titled Bad Blood Over Bad Loans.

The always interesting Greg Mankiw illustrates the concept of "framing" with an article from the Wall Street Journal. As always, read his comments section, too.

Marketwatch.com discusses the increased in the recent number of stock buybacks, along with some good discussion of the implications for investors.

Finally, today's Wall Street Journal reports on some of the costs associated with starting (and maintaining) an algorithmic trading system.

So it must be time to get to work.

24 Eylül 2006 Pazar

Ideas - The Memento Edition

Here's a cartoon from a short while back from Piled Higher and Deeper.

It used to happen to me a lot more when I had a 45 minute commute to my office. All too often I'd have what seemed to be a great insight (or come up with a great turn of a phrase) in my car, and by the time I got to my office, I'd be drawing blanks.

That's why I've started keeping a small tape recorder with me. I'm no Guy Pearce, but I realize that I've got so much stuff going on that I can't depend on my memory anymore. And you never know when a good idea will hit you.

It used to happen to me a lot more when I had a 45 minute commute to my office. All too often I'd have what seemed to be a great insight (or come up with a great turn of a phrase) in my car, and by the time I got to my office, I'd be drawing blanks.

That's why I've started keeping a small tape recorder with me. I'm no Guy Pearce, but I realize that I've got so much stuff going on that I can't depend on my memory anymore. And you never know when a good idea will hit you.

23 Eylül 2006 Cumartesi

Saturday Link Dump

Unknown Daughter and Unknown Wife are going away for an overnight with Unknown Niece and Unknown Sister-In-Law. So, it's a boy's couple of days for the Lad and I. I'm putting in a couple of hours at the office while the rest of my family is at my daughter's soccer game, so I thought I'd post a few things for your reading pleasure.

I'll probably post more later. After Unknown Son and I do some Guy Things, we'll probably go to my office for a bit -- I'll use my laptop, and he'll use my computer. He's got a lot of internet games he likes to play and I've got two 19'' monitors on my office system.

And yes, we're a couple of nerds. Not that there's anything wrong with that.

Tim Harford's Dear Economist columns are now available online here, with an RSS feed here. Browse through some of his back columns - he's one of the best comenters out there when it comes to applying economic principles to just about anything you can imagine (and a few you can't).

Calculated Risk reports on the implied probabilities that the Fed will either pause in their increases or even cut rates in December - they're increasing.

Truth On The Market adds his $0.02 to the back-and-forth on options backdating in the blogosphere. He's also got links to previous posts by others.

ProfessorBainbridge.com links to this violent (but funny, in a sick kind of way) online procrastination tool. You've been warned...

And yes, we're a couple of nerds. Not that there's anything wrong with that.

21 Eylül 2006 Perşembe

Friday Link Dump

As we close out yet another week, I'm still buried. So, here are the links for today.

Enough for now - back to work.

Update (9/24): Somehow, I must have hit the wrong button - I inadvertantly saved this as a draft rather than publishing it. So, the links are a few days out of date. I must need more coffee.

DealBook reports on a study that shows that so-called private equity flips (i.e. taking a firm private and then bringing it back to public status in a short period) fails to much shareholder value.

In another article, Dealbook reports on how private equity has created a lot of job opportunities for CFOs.

Professorbainbridge.com tells us how much of the focus on corporate governance is misplaced -- agency costs aren't the be-all and end-all they're made out to be.

Larry Ribstein at Ideoblog points out the first article on Backdating by law profs (there've been quite a few by finance folks).

From the WSJ -- my addiction just got more expensive (by $0.05 a dose). Ah well, I'll still get my StarCrack.

Update (9/24): Somehow, I must have hit the wrong button - I inadvertantly saved this as a draft rather than publishing it. So, the links are a few days out of date. I must need more coffee.

Thursday Link Dump

Here's the latest Link Dump:

DealBook comments on the growing popularity of the “buyout-hunting game” (i.e. predicting which firms are likely to be the next targets of P-E firms)Enough for now- time to get back to my "real" job. I've got referee reports to write and data to torture.

CXO Advisory Group reviews a study that compares "behavioral finance" run mutual funds to good old fashioned, value funds.

Here's the latest FOMC press release. The main news: no rate increases for now, since the housing market is tanking and inflation seems likely to slow down in the near term.

ProfessorBainbridge.com asks the question "Can Sarbanes-Oxley 404 Be Fixed?"

In other Sarbox news, The Financial Times has an opinion piece by the Chief Executive of the London Stock Exchange. She argues that the loss of U.S. IPO listing business to the LSE is due to the fact that it's simply a better exchange.

The Wall Street Journal (online subscription required) just published its annual ranking of MBA programs.Statistical Modeling, Causal Inference, and Social Science reports on a paper by Alan Gerber and Neil Malhotra on the bias in journals towards papers that report "statistically significant" results.

Finally, Sound Money Tips has some good advice on saving money on toy purchases. I particularly liked the link provided for buying used toys.

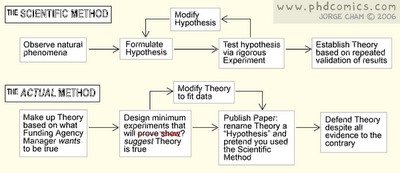

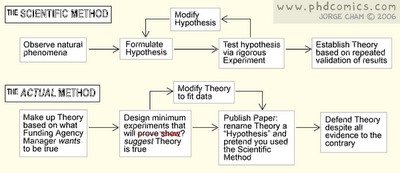

Piled Higher And Deeper Explains The Scientific Method

One of my favorite quotes is "In theory, there's no difference between theory and practice; In practice, there is."

Piled Higher and Deeper illustrates it in this cartoon (note: if you can't read it, click on the picture for a larger version in a separate window).

Not that anyone I know would ever do something like this...

Piled Higher and Deeper illustrates it in this cartoon (note: if you can't read it, click on the picture for a larger version in a separate window).

Not that anyone I know would ever do something like this...

20 Eylül 2006 Çarşamba

Wednesday Link Dump

Like I mentioned before, a lot of my blogging for the time being might be of the "link dump" variety , where I merely put up links to interesting (to me) pieces I've come across. This way I can keep my bloglines account from overflowing, send you some food for thought, and not overload myself. So, without further ado, here's the latest dump:

Enough bloggery for now -- back to preparing for class. Appropriately enough, we're discussing margin requirements today.

The SEC just issued clarifications on how companies should account for options backdating. The New York Times reports on it here, with the usual good commentary by Jack Siesilski at The AAO Weblog here. And if you want a quick primer on the topic, I've written one here.

ProfessorBainbridge talks about a recent report indicating that there's high levels of insider trading.

Joe Carter has his latest in the Yak Shaving Razor up at Evangelical Outpost. I'm impressed by the range of stuff he finds.

Finally, there were a couple of good Wall Street Journal (online subscription required) articles lately that might be of interest to finance faculty. In one, they report on Ford Suspending Its Dividends - a good piece for all of you if you're currently discussing dividends, signaling, or restructuring in class.

Another WSJ piece discuss how regulators are looking at whether banks and brokerage houses are enforcing margin requirements for hedge fund clients.

Economist's View on publication bias

18 Eylül 2006 Pazartesi

Monday Link Dump

I'm still trying to get ahead in my new classes, so I might not be doing much blogging (other than "link dumps) in the next couple of days. So, here's the Monday Edition:

Marketwatch.com discusses how activist hedge funds are finding fewer opportunities these days.Hopefully, regularly scheduled bloggery will resume in a day or two. At least this way, you'll see some articles you might have missed (and my feed reader won't end up overflowing).

The New York Times lists which 4-year colleges have the worst graduation rates. I have a buddy who teaches at one to them, so I'll have to send the piece to him to see how much grief he's caught from it.

The Wall Street Journal (note: online subscription required) shows that it's not necessary to have an Ivy-League degree to be a CEO of a top company. In fact, only about 10% do.

Flexo at Consumerism Commentary has a link to a Kiplingers article on how to find financial advice (for a fee) online.

Power Prof at Just Tenured shares her resolutions for the new academic year.

This week's Carnival of Personal Finance is up at Free Money Finance, the Carnival of Investing is up at Consumerism Commentary, and this week's Carnival of the Capitalists is up (kind of) at OkDork.com.

15 Eylül 2006 Cuma

12 Eylül 2006 Salı

Wednesday Link Dump

What with getting up to speed on my new classes and the usual beginning of semester "big ball-o-crazy", I've been a bit pressed for time. So instead of posting at length, I thought I'd just put some links up to interesting stuff I've recently come across:

The AAO Weblog links to a great article on CFO.com titled "Is Spring-Loading Wrong? " It contains a phrase (at least to me)--“bullet-dodging.” This refers to the phenomenon where a firm delays the granting of options until after bad news has been revealed.This should be enough to keep y'all busy. Enjoy.

Barry Ritholtz of The Big Picture refers to brokers of exotic mortgage as "the new boiler rooms." In case you don't understand the reference, rent this movie.

Evangelical Outpost has their latest in their continuing Yak Shaving Razor series.

Vikas Bajaj from the New York Times reports on this interesting (to me, at least) combination of facts: default rates on mortgages are rising, but they're more popular than ever with investors.

And finally, from the Wall Street Journal (online subscription required), Peter McKay reports on recent insider trading indicators. He notes that the ratio of insider sales to insider purchases at large-cap companies is low by historical standards - a bullish indicator.

9 Eylül 2006 Cumartesi

Opening The Class: The "First Day"

It's the beginning of a new semester, so I've been thinking about how I should open my new classes.

Over the years, I've changed what I do for a typical "first class". When I first started teaching, I would go through the syllabus in great detail. After that (if there was time), I'd get into the material. I was never really comfortable with that approach, because it alsways seemed to suck the life out of the class. But that's what everyone around me was doing, so I figured I might as well too (insert comment about lemmings here).

But a couple of years back, I read this short piece by Robert Bruner (now Dean of UVA's Darden School of Business) titled "Opening a Course." Here's the abstract:

Probably the best advice I got from the piece was that the first class:

I may actually apologize to the class for being out of sorts. If nothing else, it'll surprise them...

Over the years, I've changed what I do for a typical "first class". When I first started teaching, I would go through the syllabus in great detail. After that (if there was time), I'd get into the material. I was never really comfortable with that approach, because it alsways seemed to suck the life out of the class. But that's what everyone around me was doing, so I figured I might as well too (insert comment about lemmings here).

But a couple of years back, I read this short piece by Robert Bruner (now Dean of UVA's Darden School of Business) titled "Opening a Course." Here's the abstract:

You can read the whole thing on SSRN here. It's only a couple of pages, and well worth the timeProfessor C. Roland Christensen, once remarked that the management of beginnings and endings was among the most important, but least appreciated, professional skills. Professors are trained to focus on the substantive middle, the beef, as it were, in the intellectual burger. All too often the buns must fend for themselves. Such neglect can be costly. A faulty start to a course can create a legacy that will haunt the instructor for the rest of the course, or worse. A bad beginning makes a bad ending said Euripides. The reality is that first impressions are hugely important within the classroom. How can one get a course launched well? Several instructors shared ideas with me; their comments addressed a variety of aims and tactics.

Probably the best advice I got from the piece was that the first class:

- Should be high energy

- Have some substance

- Give an overview of the course

- Set some expectations

I may actually apologize to the class for being out of sorts. If nothing else, it'll surprise them...

First Impressions of the New Semester

The first week of classes at Unknown University (v2.0) is now (as Monty Python would have said) "Now of interest only to historians." Here are some first impressions:

I still have to finish my syllabus for the second course. Since it meets the first time this coming Monday night, I'll probably get it done sometime around Monday afternoon. At Unknown University (v2.0), we believe in "just in time syllabi". Once that class has met, I can relax a bit and get back to all the research I've been neglecting.

Stay tuned.

- In the first class meeting the students were a bit non-responsive, but it's often that way the first day of the fall semester (I call it the "Damn! Summer's over! I'm depressed" effect). Don't worry, my students, your teachers feel it too. I covered the first chapter and all the administrative BS in a 50 minute class, so they might have been in a bit of shock. In the 2nd meeting, I must have called on (or had volunteers from) over 15 out of the 35 students in the class. So, I think the expectations have been set, and things are off to a good start.

- Our first faculty meeting lasted only 25 minutes, so there seems to be good leadership at least in that area. Since we have a new dean, no one knows how he'll match up in the either areas, but time will tell.

- The vast majority of the faculty here seems to be pretty easy going. They've decided to do happy hour twice a month on Friday afternoons - another very good sign.

I still have to finish my syllabus for the second course. Since it meets the first time this coming Monday night, I'll probably get it done sometime around Monday afternoon. At Unknown University (v2.0), we believe in "just in time syllabi". Once that class has met, I can relax a bit and get back to all the research I've been neglecting.

Stay tuned.

7 Eylül 2006 Perşembe

Faculty Meeting Dialogue Structure.

Profgrrrrl found something to keep her occupied during faculty meetings. In this piece, she breaks down the "normal" dialogue that takes place in faculty meeting all over the country.

Does this mean she'll end up taking the minutes of the meetings? If she did, I'm sure they'd read a lot better than the ones I usually see.

I think I'll make a faculty meeting bingo card out of it. We have our first college-wide one of the semester today.

HT: Mike Munger by way of Craig NewmarkUpdate:

I was very pleasantly surprised - the college of business faculty meeting was over in only 25 minutes. I hope it's trend that'll continue, but I doubt it.

Does this mean she'll end up taking the minutes of the meetings? If she did, I'm sure they'd read a lot better than the ones I usually see.

I think I'll make a faculty meeting bingo card out of it. We have our first college-wide one of the semester today.

HT: Mike Munger by way of Craig NewmarkUpdate:

I was very pleasantly surprised - the college of business faculty meeting was over in only 25 minutes. I hope it's trend that'll continue, but I doubt it.

6 Eylül 2006 Çarşamba

How NOT to Study For The CFA

The season is starting for CFA prep courses - Level 1 is in December. Since I'll be teaching in the CFA program this fall (and Spring), I thought this little piece was pretty funny. Think of it as the payback for not getting ahead on things like studying:

Read the whole thing here.

And stock up on the Red Bull just in case...

Note: If you're new to Financial Rounds , welcome. I hope you look around a bit -- if you want to find out more about the blog, check out the Frequently Asked Questions (FAQ) page. And if your want to subscribe to our RSS feed, there are links on the sidebar.

...And then the next question- do I use the %-of-completion method or the installment sales method? How could I possibly know that? I stand up quickly and knock my Redbull all over my Book 3 Study Notes. I start to cry. I can’t stop. That’s the book with all the FSA stuff in it. I’ve wasted the past 3 months of my life studying and not retaining anything and now I have spilled redbull all over my FSA Study Notes. My roommate found me 3 hours later passed out drunk, shredded pieces of Book 3 and my practice exam lying all around me.**”

And stock up on the Red Bull just in case...

Note: If you're new to Financial Rounds , welcome. I hope you look around a bit -- if you want to find out more about the blog, check out the Frequently Asked Questions (FAQ) page. And if your want to subscribe to our RSS feed, there are links on the sidebar.

5 Eylül 2006 Salı

Giving The Kids A Classical Education (Rubber Cockroach Edition)

We do our best in the Unknown Household to give the Unknown kids a classical education -- Bugs Bunny, Tom and Jerry, Popeye, and (as soon as I get the DVD) The Three Stooges.

They're still getting the hang of practical jokes. But I'm trying to do my part.

Tonight Unknown Son, Unknown Daughter, and I planted a LARGE (and very realistic) rubber cockroach in the middle of the kitchen floor. Unknown Wife was blissfully aware, talking on the phone with her mother, with her back to us. The kids peeked around the corner and were barely able to keep quiet as they waited for things to unfold.

Unknown Wife didn't disappoint. The scream was priceless, and made the kids' night. Looks like they'll have something to tell their new friends in school tomorrow (today was the first day).

Like I said, a classical education.

They're still getting the hang of practical jokes. But I'm trying to do my part.

Tonight Unknown Son, Unknown Daughter, and I planted a LARGE (and very realistic) rubber cockroach in the middle of the kitchen floor. Unknown Wife was blissfully aware, talking on the phone with her mother, with her back to us. The kids peeked around the corner and were barely able to keep quiet as they waited for things to unfold.

Unknown Wife didn't disappoint. The scream was priceless, and made the kids' night. Looks like they'll have something to tell their new friends in school tomorrow (today was the first day).

Like I said, a classical education.

Don't Say These Things If You Want Sympathy From Your Professor

Professor Steve Dutch (U of Wisconsin - Green Bay) offers a list of some things you might not want to say to your professor if you expect ANY sympathy. Think of it as a TOP TEN list with a few bonus items:

The full piece has a lot of comments after each line that explain WHY they're not particularly good things to say. All in all, it gives a pretty good picture of your professors' mindsets.

Since classes just started (and I'm at a new school), this looks like a pretty good candidate for the first thing I put up on my door.

HT: Newmark's Door

- This Course Covered Too Much Material...

- The Expected Grade Just for Coming to Class is a B

- I Disagreed With the Professor's Stand on ----

- Some Topics in Class Weren't on the Exams

- Do You Give Out a Study Guide?

- I Studied for Hours

- I Know The Material - I Just Don't Do Well on Exams

- I Don't Have Time For All This (...but you don't understand - I have a job.)

- Students Are Customers

- Do I Need to Know This?

- There Was Too Much Memorization

- This Course Wasn't Relevant

- Exams Don't Reflect Real Life

- I Paid Good Money for This Course and I Deserve a Good Grade

- All I Want Is The Diploma

The full piece has a lot of comments after each line that explain WHY they're not particularly good things to say. All in all, it gives a pretty good picture of your professors' mindsets.

Since classes just started (and I'm at a new school), this looks like a pretty good candidate for the first thing I put up on my door.

HT: Newmark's Door

This Week's Carnival of The Capitalists

This week's COTC is up at The Business of America is Business, compliments of our host Professor Starling Hunter. He's hosting for the second time in a month (talk about a glutton for punishment). He's got a great format for this week's Carnival - he starts with the question each article answers. As usual, here are my picks of the week:

Dan Melson of Searchlight Crusade answers the question Why Is There Money in Fixer Properties?Here's the usual disclaimer: My tastes are probably different from yours. So look around - There's always lots of good stuff at a Carnival.

Debt Free provides The Three Strategies to Maximize Your Financial Success.

4 Eylül 2006 Pazartesi

Ben Stein Punts One on Management Buyouts

I almost always enjoy reading whatever Ben Stein's writes - he's an old school kind of guy who generally hits most nails he aims at right on the head. But I got a kick out of his recent New York Times piece where he rails against the injustice of Management Buyouts (MBOs). Unfortunately, the reason I got a kick out of it is that his arguments are both over the top and incredibly off base.

He mentions MBOs in the same breath as segregation and housing discrimination, and says that "...by every standard I can see, they are yet another sad sign of how our corporate trustees have lost their moral compass."

Read the full piece here (Note: online subscription required)

The basic premise behind his screed (and I think it's an appropriate word) is that it's wrong for management to use their private information to buy up corporate assets on the cheap.

I have at least a couple of problems with his analysis:

First, what evidence I've seen on MBOs seems to show that the stockholders of the parent company make out about as well when a division is taken private in an MBO as they do when the division is sold to a third party (i.e. in an arms-length asset sale). So, managers on average seem to offer shareholders the same deal as they would have gotten elsewhere.

Second, I think Stein is guilty of "cherry picking." He may not be aware of it, but his cases are most likely not a representative sample. He gives some examples of MBOs where the management made a huge profit. However, the appropriate metric would be the returns for ALL MBOs, not just the successful ones.

Third, even if MBOs on average are extremely successful, the managers doing them bear a huge amount of risk. They typically take large equity stakes in these firms, and therefore end up holding an extremely undiversified position. If the MBO fails, they stand to lose what often represents a major portion of their personal wealth. And as we all know (at least, if we've taken an introductory finance class), bearing higher risk should be compensated by a higher expected return, or people won't take the risk.

Finally, in MBOs, managers typically pay a premium above the current perceived value of the division. And the shareholders APPROVE the deals (or at least the board of directors does). A evidence, the abnormal return to the firms selling the division are positive in most cases (and are statistically quite significant). If managers are making such a killing, it should show up in the returns to the parent company. It doesn't. And if it' such a good deal for the managers, why doesn't another firm swoop down and outbid them?

All in all, a disappointing piece, and not up to Stein's usual standards.

Oh well, everyone has an occasional off day. He does so many things so well that I guess he's due for one, too.

Update: For further commentary on the topic, be sure to read what Equity Private (Going Private) and Larry Ribstein (Ideoblog) have to say.

As usual, they say it better than me (damn!)

He mentions MBOs in the same breath as segregation and housing discrimination, and says that "...by every standard I can see, they are yet another sad sign of how our corporate trustees have lost their moral compass."

Read the full piece here (Note: online subscription required)

The basic premise behind his screed (and I think it's an appropriate word) is that it's wrong for management to use their private information to buy up corporate assets on the cheap.

I have at least a couple of problems with his analysis:

First, what evidence I've seen on MBOs seems to show that the stockholders of the parent company make out about as well when a division is taken private in an MBO as they do when the division is sold to a third party (i.e. in an arms-length asset sale). So, managers on average seem to offer shareholders the same deal as they would have gotten elsewhere.

Second, I think Stein is guilty of "cherry picking." He may not be aware of it, but his cases are most likely not a representative sample. He gives some examples of MBOs where the management made a huge profit. However, the appropriate metric would be the returns for ALL MBOs, not just the successful ones.

Third, even if MBOs on average are extremely successful, the managers doing them bear a huge amount of risk. They typically take large equity stakes in these firms, and therefore end up holding an extremely undiversified position. If the MBO fails, they stand to lose what often represents a major portion of their personal wealth. And as we all know (at least, if we've taken an introductory finance class), bearing higher risk should be compensated by a higher expected return, or people won't take the risk.

Finally, in MBOs, managers typically pay a premium above the current perceived value of the division. And the shareholders APPROVE the deals (or at least the board of directors does). A evidence, the abnormal return to the firms selling the division are positive in most cases (and are statistically quite significant). If managers are making such a killing, it should show up in the returns to the parent company. It doesn't. And if it' such a good deal for the managers, why doesn't another firm swoop down and outbid them?

All in all, a disappointing piece, and not up to Stein's usual standards.

Oh well, everyone has an occasional off day. He does so many things so well that I guess he's due for one, too.

Update: For further commentary on the topic, be sure to read what Equity Private (Going Private) and Larry Ribstein (Ideoblog) have to say.

As usual, they say it better than me (damn!)

New (To Me, at Least) Corporate Governance Blog

I've just added a new blog to the blogroll - Institutional Shareholders Services (ISS) Corporate Governance Blog.

ISS is one of the major players in the corporate governance world. They're best known for their role in advising shareholders in the proxy process, but also have their fingers in a lot of other corporate governance-related pies. They've been blogging since February of this year, and have a lot of interesting stuff up there. Give them a look (I've already found some good stuff for my classes).

ISS is one of the major players in the corporate governance world. They're best known for their role in advising shareholders in the proxy process, but also have their fingers in a lot of other corporate governance-related pies. They've been blogging since February of this year, and have a lot of interesting stuff up there. Give them a look (I've already found some good stuff for my classes).

2 Eylül 2006 Cumartesi

The Economics of Oral Sex

Sorry, I just couldn't resist. Tim Harford (author of The Undercover Economist) has a great way of applying the principles of economics to topics you'd never expect. In his latest Slate column, he uses economics to explain the recent rise in oral sex among teenagers:

And you thought econonomics was boring.

HT: Alex Tabarrok at Marginal Revolution.

Read the whole thing here.Now, there is no shortage of explanations: Perhaps everyone just thought that if it was good enough for Bill Clinton and Monica Lewinsky, it was good enough for them. But an economic explanation would instead start with the premise that this is a response to changing incentives.

And you thought econonomics was boring.

HT: Alex Tabarrok at Marginal Revolution.

What I Did This Summer

Kick starting this Blog again.

I s'pose it's time to revive this blog. I kinda forgot this thing, thinking it had faded out.

So I'm a roadie again, which could make for more exciting dharma bummage reading for y'all out there.

I haven't read my last blog entries, but I think I did them in early spring, and I hardly remember what I wrote - mainly just my feelings - squirming in doubt & navel-gazing. Now I feel I have a revived confidence again.

It's been a sweet summer, packed with zillions of "realities". Now I'm in Portland, Oregon, presently sipping red-cedar tea (from the tree outside) at my friend Helen's house, where I crash off & on when I'm not camping by the river. Helen has actually opened up this house as a kind of Buddhist temple to be shared. It's funny how the universe threw us together. She is a wealthy person who is realizing her wealth is not her own. She is devoting her life to generosity & openness. She respects my moneyless lifestyle & philosophy more than most anybody. She is one of the few moneyed people who doesn't try to take care of me and buy me things, and she totally accepts and feasts on my scavenged offerings for the treasures they are.

Now, back to where I left off in the Spring.

In early May, my parents came through Moab & whisked me away for a couple weeks to the northern California coast to celebrate their 57th wedding anniversary. It was interesting seeing all the places I'd walked by a couple years ago when I trekked down the Cali coast. Now I saw it through tourist eyes. Before, I'd seen it through vagabond eyes, from outside those same tourist trappings, and sometimes from inside those trappings' dumpsters. Yeah, it's good to immerse yourself into contrasting "realities" to keep your mind open and refuged in the Only Reality. The Only Reality is that which never changes. And it was good to spend time with my parents, as life is fleeting and every moment precious - yet on the other hand not to be taken too seriously - precisely because it is fleeting. My parents, who are conservative Christians, never say a judging word about my radical lifestyle. They know this is how I see life as prescribed by Jesus, and so it happens also to be life prescribed by Lao Tzu, Buddha, Krishna, Mohammad, Mahavir, Francis of Assisi, Peace Pilgrim, the Rhine Christian sages, the great Native American sages and shamans of the world. Of course I'm not forgetting the great female sages of the world who relinquished their names being known, even as the recessive chromosomes secretly pass down the greatest and profoundest secrets of our biology. Yes, as I see it, this is the life prescribed by all the wild creatures.

Moab closure.

After Dad & Mom brought me back to Moab at the end of May, I was psyched that Gordon & Kay then came from Connecticut to visit me. I happened to have a lovely house-sit at the time so I could luxuriously put them up in their own room. I'm toying with the idea of hopping a train east to see them again, along with my other long-lost close friends over there.

After G & K left, it was time to get ready to hit the road. I cleared out all my accumulations from the treehouse and cleaned my stealth cave in the canyon, closing it up with rocks as a final touch. The treehouse was my town house, in my friend Pennie's backyard. But I was feeling odd about staying there lately, because her neighbor told her he didn't like me staying there. Why? Because he said I didn't work, that I "spooked" him. If he had allowed me even once to make eye contact with him, not to mention speak with him, he might think differently. Funny thing is, that neighbor, like me, isn't employed for money but, unlike me, he lives on government dole. It all keeps life funny.

Rainbow Dharma Bumstead

I never was able to hook up with my friend Val to go scouting for the Rainbow Gathering. This year I was feeling a little reluctant about going to the Gathering, much less scouting for it again. But I thought about it, and realized this was the closest thing to my vision of a moneyless world in existence - at least in the US. Whether I could admit it or not, Rainbow is my tribe, and how could I forsake meeting with them? Besides, this year it was close by, near Steamboat Springs, Colorado. My semi-vagabond friend Phil was getting ready for his summer job in Aspen and took me half-way to the Gathering on his way to Aspen. Then I hitched, & two young women, Denise & Ginger, picked me up & took me into the Gathering.

This time I decided to wipe my mind free of all judgment, & the Gathering turned out the best I'd ever been to. I had a realization that the Rainbow Gathering is as ancient as humanity, and as long as there is humanity, it will exist, whatever name it has taken on or will take on. Wipe the mind free of judgment, and the world opens up in magical splendor. See the world through the eyes of an infant, with no past programming.

So the Gathering was splendid, even with its usual harassment by the authorities. But it's the drama as old as civilization: Civilization's authorities & pawns only want people to talk about Life, Liberty, and the Pursuit of Happiness. But don't dare practice it. Isn't Religion the same? Keep it a fanatical lipservice so people think you're a spiritual zealot, or else a mushy liberal sweet talk, but don't dare live it, don't dare have any courage, any Faith. Don't dare give up control, cuz if you do your whole religious ediface & civilization will collapse, whether you call yourself conservative or liberal.

At the Gathering I ran into Satya, the former Zen priest I wandered & camped with on the west coast. He's the reason I'm now at Helen's, because he stays here, and he first introduced me to her in California years ago. Satya no longer calls himself a Zen priest, because such labels are too constricting & dogmatic. He's still a spiritual seeker, even more seriously than before. And Satya is now a Rainbower. And, funny thing about Denise (you know, the lass who picked me up hitching to this gathering)... Satya already knew her from Portland. And it turns out Denise and I have become good friends. She took me here to Oregon after the Gathering.

Family Affairs

Denise and I left the Gathering with a new friend, Clay. Since we were passing by my parents' house in Fruita, Colorado, we dropped in on them. My parents were their usual happy and welcoming selves. They've always been elated to have whatever vagabond friends I'd bring to their doorstep. We thought we were just going to stay a night & leave in the morning, but we ended up staying several nights. Denise was totally charming, and I think my parents appreciated that. She discussed her Jewishness & my parents discussed their Christian-ness, and it worked out nicely.

We rolled on to Utah, where we hit some hot springs, then stayed with Clay's aunt, then with his brother. Denise & I left Clay at his brother's in Salt Lake City and headed to Idaho. We met up with the "Warriors of the Light" bus from the Rainbow gathering in Boise, then headed to Oregon.

Everything Is Prayer, Desireless.

A funny thing happened. We had been getting dumpster food the whole way, eating very luxuriously & extravagantly & healthily. But one day we were jonesing for snacks. Denise said we should think about something that's more healthy this time, since there's such an abundance of bad junk food. So I said the first thing that popped into my mind: "Garden of Eaten Blue Corn Tortilla Chips, maybe with salsa." We kind of laughed, because it was so specific and I wasn't sure why that brand specifically came to mind. About 20 minutes later we hit a dumpster in a small Idaho town. Right on top of all the food was a sealed bag of Garden of Eaten Blue Corn Tortilla chips. And all around it was an abundance of food, including salsa and packets of vegan chili and tomatoes & other vegetables. Funny thing, I've never found blue corn chips in any dumpster before, much less that brand.

Denise and I then talked about prayer and manifestation. The odd thing about prayer is that you don't decide something and pray for it. You tap into what already is and state it. Or, rather, what already is taps into you. You simply submit to the will of the universe and decide that whatever comes is good. You simply state what is. But it appears to folks around you that you are commanding God to give you something, when in actuality you are simply stating what already is destined to be. You are submitting to God, God isn't submitting to you. God isn't a genie in a bottle, and nothing is to be forced and nothing to be desired. But as time goes you realize that in the greater picture you and God are one - one will. True prayer is a statement of the splendor of What Is, not desire of what will be. Give us this day our daily bread. No worry of tomorrow's bread.

Timo's & Logan's Run.

Denise dropped me off at the turn-off to Redmond & she went on to Portland. She would have taken me clear to Redmond, but I insisted that she take the quicker route & I could just hitch to my friend Timo's in Redmond in central Oregon. I camped by the Deschutes River on the way. I found a place where deer bedded down on the grass. I almost stepped on a rattle snake, and I found 5 ticks on me the next morning. A van full of 4 old men and one old woman took me almost to Redmond, cracking crude jokes & laughing the whole way. Then another old man in a jeep took me to Timo's front step in Redmond. I was so happy to see Timo and his daughter Logan - it's been a few years. I stayed with them around a week, going on hikes & swims with them and their neighbors, Matt & his son Kyler. I also got to help shingle a roof and play with left-over wet cement, making figurines for Logan.

Lord of the Dance.

Then Timo took me to Portland and dropped me off here at Helen's. Helen is learning Nepali dance under a Nepali dance master named Prajwal Vajracharya, and I happened to get in on a dance lesson that first evening. I did a second a couple days later. This dance form is an ancient form of Buddhist meditation. In the past it was passed down through the Vajracharya clan of dance priests and shown only to fellow Buddhist priests. Then it was opened up to other Nepalis. Prajwal is of the only existing lineage of this dance, having learned it from his father. But his father instructed him to finally open it up to the west, and to teach westerners. So having him here is a rare privilege.

Street kids & vague bonds.

It's been a whole other odyssey in Portland. It's grand to see old forest activist friends. The forest activist scene has pretty much dissolved in Portland, that I know of, but many of my fellow tree-sitters are still here. Eugene is the hub of forest activism now. A lot of my friends are hooked up with Food Not Bombs, cooking & serving to fellow street folks. The vegan food comes from kick-downs from natural food stores and dumpsters. So I've been doing that a lot (both on the cooking and the eating end), and meeting soul-mates everywhere. I don't feel like an oddity in Portland. Living without money isn't such a big deal here, and generosity abounds. But I still haven't met anybody else who lives completely without money, though most my friends nearly do. (If anybody out there has heard of anybody else since Peace Pilgrim who has lived or lives moneyless, let me know).

Desert Rat turns River Rat

Speaking of which, I haven't wanted to be dependent on wealthy people, so I've started camping at the river. I have visions of living on a little desert island on the river. I've got a prime spot set aside, and am preparing to build a log raft and maybe build an earthen structure out there. I've already floated a couple pallets with plywood out there for a bed. But I might end up heading east - so who knows yet.

Denise & Magic Machik

A couple weeks ago Denise and a new young woman friend, Machik, and I went to the ocean to camp in a cave and harvest seaweed for a few days. It was enchanting - the deep familial love among us 3, on top of the intense power of the ocean. Denise & I have clicked together like brother & sister, and now we have a 3rd sibling, Machik. Machik has been staying at Helen's, along with Satya, and is a fellow spiritual seeker. She is one of the most loving, kind, wise, joyful and enlightened people I've ever met - perhaps the most. She's really young, early 20s, and makes me wonder how slowly I've come along all these years. It's good to be humbled like that. On the surface she seems like your classic hippy-chick, airy-fairy and all that. But then you see something amazing & divine bursting through - a thoughtful intelligence & wisdom, a balance of intuition & logic. She fits no mold, no category, no religious label. Everybody she meets, she makes them feel like the center of her universe; and indeed they are. She observes and states your seeming failings with pure love & non-judgment. And her touch is powerful & heeling, pouring out love. Denise said it was wonderful that so much physical affection could come without the sexual trappings. In our society, affection is too often either sexual or non-existent. But the 3 of us had a physical & spiritual affection like sibling children. And I don't think it would have happened without Machik. I suppose that's what I need to learn in order to be with fellow gay men.

So how can I say anything but life is sparkling Now, and there's really no place to go but Here and nothing to look forward to but Now, the Great I Am Who I Am. When you're a devout Christian you realize this, and then you realize you are a devout Hindu, a devout Buddhist, a devout Jew, a devout Muslim, a devout Taoist, a devout Scientist, a devout Naturalist, a devout liver of Life. You realize that I am not saying this to be P.C. and give everybody a New Agey airy-fairy fair shot, but that it is indeed true. What did Moses realize at the burning bush, but I Am Who I Am and nothing else real exists?

I s'pose it's time to revive this blog. I kinda forgot this thing, thinking it had faded out.

So I'm a roadie again, which could make for more exciting dharma bummage reading for y'all out there.

I haven't read my last blog entries, but I think I did them in early spring, and I hardly remember what I wrote - mainly just my feelings - squirming in doubt & navel-gazing. Now I feel I have a revived confidence again.

It's been a sweet summer, packed with zillions of "realities". Now I'm in Portland, Oregon, presently sipping red-cedar tea (from the tree outside) at my friend Helen's house, where I crash off & on when I'm not camping by the river. Helen has actually opened up this house as a kind of Buddhist temple to be shared. It's funny how the universe threw us together. She is a wealthy person who is realizing her wealth is not her own. She is devoting her life to generosity & openness. She respects my moneyless lifestyle & philosophy more than most anybody. She is one of the few moneyed people who doesn't try to take care of me and buy me things, and she totally accepts and feasts on my scavenged offerings for the treasures they are.

Now, back to where I left off in the Spring.

In early May, my parents came through Moab & whisked me away for a couple weeks to the northern California coast to celebrate their 57th wedding anniversary. It was interesting seeing all the places I'd walked by a couple years ago when I trekked down the Cali coast. Now I saw it through tourist eyes. Before, I'd seen it through vagabond eyes, from outside those same tourist trappings, and sometimes from inside those trappings' dumpsters. Yeah, it's good to immerse yourself into contrasting "realities" to keep your mind open and refuged in the Only Reality. The Only Reality is that which never changes. And it was good to spend time with my parents, as life is fleeting and every moment precious - yet on the other hand not to be taken too seriously - precisely because it is fleeting. My parents, who are conservative Christians, never say a judging word about my radical lifestyle. They know this is how I see life as prescribed by Jesus, and so it happens also to be life prescribed by Lao Tzu, Buddha, Krishna, Mohammad, Mahavir, Francis of Assisi, Peace Pilgrim, the Rhine Christian sages, the great Native American sages and shamans of the world. Of course I'm not forgetting the great female sages of the world who relinquished their names being known, even as the recessive chromosomes secretly pass down the greatest and profoundest secrets of our biology. Yes, as I see it, this is the life prescribed by all the wild creatures.

Moab closure.

After Dad & Mom brought me back to Moab at the end of May, I was psyched that Gordon & Kay then came from Connecticut to visit me. I happened to have a lovely house-sit at the time so I could luxuriously put them up in their own room. I'm toying with the idea of hopping a train east to see them again, along with my other long-lost close friends over there.

After G & K left, it was time to get ready to hit the road. I cleared out all my accumulations from the treehouse and cleaned my stealth cave in the canyon, closing it up with rocks as a final touch. The treehouse was my town house, in my friend Pennie's backyard. But I was feeling odd about staying there lately, because her neighbor told her he didn't like me staying there. Why? Because he said I didn't work, that I "spooked" him. If he had allowed me even once to make eye contact with him, not to mention speak with him, he might think differently. Funny thing is, that neighbor, like me, isn't employed for money but, unlike me, he lives on government dole. It all keeps life funny.

Rainbow Dharma Bumstead

I never was able to hook up with my friend Val to go scouting for the Rainbow Gathering. This year I was feeling a little reluctant about going to the Gathering, much less scouting for it again. But I thought about it, and realized this was the closest thing to my vision of a moneyless world in existence - at least in the US. Whether I could admit it or not, Rainbow is my tribe, and how could I forsake meeting with them? Besides, this year it was close by, near Steamboat Springs, Colorado. My semi-vagabond friend Phil was getting ready for his summer job in Aspen and took me half-way to the Gathering on his way to Aspen. Then I hitched, & two young women, Denise & Ginger, picked me up & took me into the Gathering.

This time I decided to wipe my mind free of all judgment, & the Gathering turned out the best I'd ever been to. I had a realization that the Rainbow Gathering is as ancient as humanity, and as long as there is humanity, it will exist, whatever name it has taken on or will take on. Wipe the mind free of judgment, and the world opens up in magical splendor. See the world through the eyes of an infant, with no past programming.

So the Gathering was splendid, even with its usual harassment by the authorities. But it's the drama as old as civilization: Civilization's authorities & pawns only want people to talk about Life, Liberty, and the Pursuit of Happiness. But don't dare practice it. Isn't Religion the same? Keep it a fanatical lipservice so people think you're a spiritual zealot, or else a mushy liberal sweet talk, but don't dare live it, don't dare have any courage, any Faith. Don't dare give up control, cuz if you do your whole religious ediface & civilization will collapse, whether you call yourself conservative or liberal.

At the Gathering I ran into Satya, the former Zen priest I wandered & camped with on the west coast. He's the reason I'm now at Helen's, because he stays here, and he first introduced me to her in California years ago. Satya no longer calls himself a Zen priest, because such labels are too constricting & dogmatic. He's still a spiritual seeker, even more seriously than before. And Satya is now a Rainbower. And, funny thing about Denise (you know, the lass who picked me up hitching to this gathering)... Satya already knew her from Portland. And it turns out Denise and I have become good friends. She took me here to Oregon after the Gathering.

Family Affairs

Denise and I left the Gathering with a new friend, Clay. Since we were passing by my parents' house in Fruita, Colorado, we dropped in on them. My parents were their usual happy and welcoming selves. They've always been elated to have whatever vagabond friends I'd bring to their doorstep. We thought we were just going to stay a night & leave in the morning, but we ended up staying several nights. Denise was totally charming, and I think my parents appreciated that. She discussed her Jewishness & my parents discussed their Christian-ness, and it worked out nicely.

We rolled on to Utah, where we hit some hot springs, then stayed with Clay's aunt, then with his brother. Denise & I left Clay at his brother's in Salt Lake City and headed to Idaho. We met up with the "Warriors of the Light" bus from the Rainbow gathering in Boise, then headed to Oregon.

Everything Is Prayer, Desireless.

A funny thing happened. We had been getting dumpster food the whole way, eating very luxuriously & extravagantly & healthily. But one day we were jonesing for snacks. Denise said we should think about something that's more healthy this time, since there's such an abundance of bad junk food. So I said the first thing that popped into my mind: "Garden of Eaten Blue Corn Tortilla Chips, maybe with salsa." We kind of laughed, because it was so specific and I wasn't sure why that brand specifically came to mind. About 20 minutes later we hit a dumpster in a small Idaho town. Right on top of all the food was a sealed bag of Garden of Eaten Blue Corn Tortilla chips. And all around it was an abundance of food, including salsa and packets of vegan chili and tomatoes & other vegetables. Funny thing, I've never found blue corn chips in any dumpster before, much less that brand.

Denise and I then talked about prayer and manifestation. The odd thing about prayer is that you don't decide something and pray for it. You tap into what already is and state it. Or, rather, what already is taps into you. You simply submit to the will of the universe and decide that whatever comes is good. You simply state what is. But it appears to folks around you that you are commanding God to give you something, when in actuality you are simply stating what already is destined to be. You are submitting to God, God isn't submitting to you. God isn't a genie in a bottle, and nothing is to be forced and nothing to be desired. But as time goes you realize that in the greater picture you and God are one - one will. True prayer is a statement of the splendor of What Is, not desire of what will be. Give us this day our daily bread. No worry of tomorrow's bread.

Timo's & Logan's Run.

Denise dropped me off at the turn-off to Redmond & she went on to Portland. She would have taken me clear to Redmond, but I insisted that she take the quicker route & I could just hitch to my friend Timo's in Redmond in central Oregon. I camped by the Deschutes River on the way. I found a place where deer bedded down on the grass. I almost stepped on a rattle snake, and I found 5 ticks on me the next morning. A van full of 4 old men and one old woman took me almost to Redmond, cracking crude jokes & laughing the whole way. Then another old man in a jeep took me to Timo's front step in Redmond. I was so happy to see Timo and his daughter Logan - it's been a few years. I stayed with them around a week, going on hikes & swims with them and their neighbors, Matt & his son Kyler. I also got to help shingle a roof and play with left-over wet cement, making figurines for Logan.

Lord of the Dance.

Then Timo took me to Portland and dropped me off here at Helen's. Helen is learning Nepali dance under a Nepali dance master named Prajwal Vajracharya, and I happened to get in on a dance lesson that first evening. I did a second a couple days later. This dance form is an ancient form of Buddhist meditation. In the past it was passed down through the Vajracharya clan of dance priests and shown only to fellow Buddhist priests. Then it was opened up to other Nepalis. Prajwal is of the only existing lineage of this dance, having learned it from his father. But his father instructed him to finally open it up to the west, and to teach westerners. So having him here is a rare privilege.

Street kids & vague bonds.

It's been a whole other odyssey in Portland. It's grand to see old forest activist friends. The forest activist scene has pretty much dissolved in Portland, that I know of, but many of my fellow tree-sitters are still here. Eugene is the hub of forest activism now. A lot of my friends are hooked up with Food Not Bombs, cooking & serving to fellow street folks. The vegan food comes from kick-downs from natural food stores and dumpsters. So I've been doing that a lot (both on the cooking and the eating end), and meeting soul-mates everywhere. I don't feel like an oddity in Portland. Living without money isn't such a big deal here, and generosity abounds. But I still haven't met anybody else who lives completely without money, though most my friends nearly do. (If anybody out there has heard of anybody else since Peace Pilgrim who has lived or lives moneyless, let me know).

Desert Rat turns River Rat

Speaking of which, I haven't wanted to be dependent on wealthy people, so I've started camping at the river. I have visions of living on a little desert island on the river. I've got a prime spot set aside, and am preparing to build a log raft and maybe build an earthen structure out there. I've already floated a couple pallets with plywood out there for a bed. But I might end up heading east - so who knows yet.

Denise & Magic Machik